ST-2. Zaap.coin, Inc. is a privately held B2B startup that offers inventory management services to clients. Chent

Question:

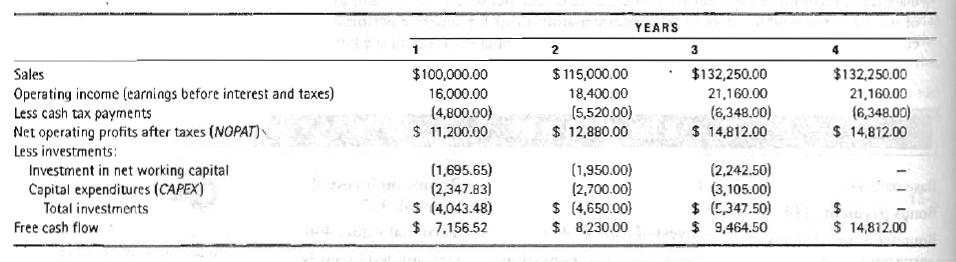

ST-2. Zaap.coin, Inc. is a privately held B2B startup that offers inventory management services to clients. Chent firms are generally small- to medium-sized manufacturing firms that 'cannot afford sophisticated inventory control practices. Zaap.com provides its services via the Internet by connecting the manufacturers directly to their suppliers and managing the ordering and pay- ment interface. Zaap.com plans to sell its shares to the general public within the next 18 months and wants to get some idea what the firm's stock will be worth. An investinent banker located in Dallas who specializes in assisting high-tech startups to go public has evaluated the company's future prospects and made the following estimates of future free cash flows:

Furthermore, the firm's investment banker had done a study of the firm's cost of capital and esti- mated the weighted average cost of capital to be approximately 12 percent.

a. What is the value of Zaap.com based on these estimates?

b. Given that Zaap.com's invested capital in year 0 is $31,304.35, what is the firm's market value added?

c. If Zaap.com has 2,000 shares of common stock outstanding and liabilities valued at $4,000, what is the value per share of its stock?

Step by Step Answer:

Financial Management Principles And Applications

ISBN: 9780131450653

10th Edition

Authors: Arthur J. Keown, J. William Petty, John D. Martin, Jr. Scott, David F.