TIME VALUE OF MONEY Answer the following questions: a. Assuming a rate of 10% annually, find the

Question:

TIME VALUE OF MONEY Answer the following questions:

a. Assuming a rate of 10% annually, find the FV of $1,000 after 5 years.

b. What is the investment’s FV at rates of 0%, 5%, and 20% after 0, 1, 2, 3, 4, and 5 years?

c. Find the PV of $1,000 due in 5 years if the discount rate is 10%.

d. What is the rate of return on a security that costs $1,000 and returns $2,000 after 5 years?

e. Suppose California’s population is 36 5 million people and its population is expected to grow by 2% annually. How long will it take for the population to double?

f. Find the PV of an ordinary annuity that pays $1,000 each of the next 5 years if the interest rate is 15%. What is the annuity’s FV?

g. How will the PV and FV of the annuity in Part f change if it is an annuity due?

h. What will the FV and the PV be for $1,000 due in 5 years if the interest rate is 10%, semiannual compounding?

i. What will the annual payments be for an ordinary annuity for 10 years with a PV of

$1,000 if the interest rate is 8%? What will the payments be if this is an annuity due?

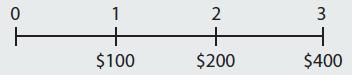

j. Find the PV and the FV of an investment that pays 8% annually and makes the following end-of-year payments:

k. Five banks offer nominal rates of 6% on deposits; but A pays interest annually, B pays semiannually, C pays quarterly, D pays monthly, and E pays daily.AppendixLO1

Step by Step Answer:

Fundamentals Of Financial Management Concise Edition

ISBN: 9781285065137

8th Edition

Authors: Eugene F. Brigham, Joel F. Houston