Imagine that you want to create your own stock index to measure the performance of the stock

Question:

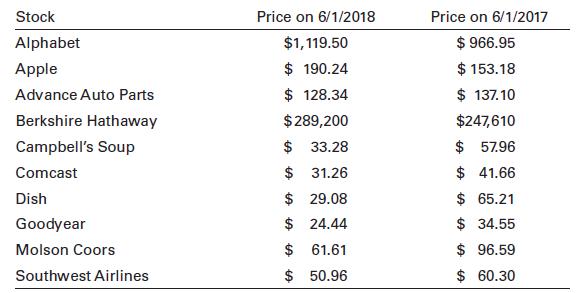

Imagine that you want to create your own stock index to measure the performance of the stock market over time. You decide to use a methodology similar to that used to calculate the DJIA (see Equation 3.1). Your index will contain 10 stocks carefully selected from different industries. The price of each stock on June 1, 2017, and June 1, 2018, is shown below. For simplicity, assume that during the year no stock splits or other events occurred that would require an adjustment to the index divisor, which is 13.5 on both dates.

a. Calculate the percentage change in the stock price of each company over this12-month period. Based on those calculations alone, would you guess that the overall stock market was up or down over this time?

b. Now use Equation 3.1 to calculate the value of your stock index on each date and calculate the percentage change in the index over the period. Does your index indicate that the market was up or down?

c. Are your findings from parts a and b consistent with each other? If not, why not? What does this have to say about how one should go about selecting stocks (or excluding stocks) from an index calculated in the same way as the Dow?

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9780135175217

14th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk