Nabor Industries is considering going public but is unsure of a fair offering price for the company.

Question:

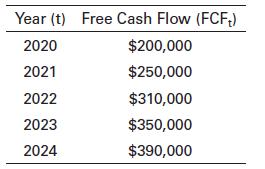

Nabor Industries is considering going public but is unsure of a fair offering price for the company. Before hiring an investment banker to assist in making the public offering, managers at Nabor have decided to make their own estimate of the firm’s common stock value. The firm’s CFO has gathered data for performing the valuation using the free cash flow valuation model. The firm’s weighted average cost of capital is 11%, and it has $1,500,000 of debt and $400,000 of preferred stock in terms of market value. The estimated free cash flows over the next five years, 2020 through 2024, are given. Beyond 2024 to infinity, the firm expects its free cash flow to grow by 3% annually.

a. Estimate the value of Nabor Industries’ entire company by using the free cash flow valuation model.

b. Use your finding in part a along with the data provided previously to find Nabor Industries’ common stock value.

c. If the firm plans to issue 200,000 shares of common stock, what is its estimated value per share?

Step by Step Answer:

Fundamentals Of Investing

ISBN: 9780135175217

14th Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk