Which of the following portfolios would be off the efficient frontier? Portfolio Expected Return Risk A 13%

Question:

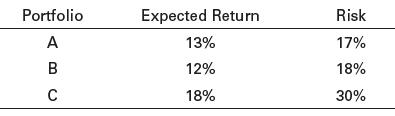

Which of the following portfolios would be off the efficient frontier?

Transcribed Image Text:

Portfolio Expected Return Risk A 13% 17% BC 12% 18% C 18% 30%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

Mustafa olang

Please accept my enthusiastic application to solutionInn. I would love the opportunity to be a hardworking, passionate member of your tutoring program. As soon as I read the description of the program, I knew I was a well-qualified candidate for the position.

I have extensive tutoring experience in a variety of fields. I have tutored in English as well as Calculus. I have helped students learn to analyze literature, write essays, understand historical events, and graph parabolas. Your program requires that tutors be able to assist students in multiple subjects, and my experience would allow me to do just that.

You also state in your job posting that you require tutors that can work with students of all ages. As a summer camp counselor, I have experience working with preschool and kindergarten-age students. I have also tutored middle school students in reading, as well as college and high school students. Through these tutoring and counseling positions, I have learned how to best teach each age group. For example, I created songs to teach my three-year-old campers the camp rules, but I gave my college student daily quizzes to help her prepare for exams.

I am passionate about helping students improve in all academic subjects. I still remember my excitement when my calculus student received her first “A” on a quiz! I am confident that my passion and experience are the qualities you are looking for at solutionInn. Thank you so much for your time and consideration.

4.80+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Investing

ISBN: 9781292153988

13th Global Edition

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

Question Posted:

Students also viewed these Business questions

-

Northern Virginia Community College HOW MUCH FINANCIAL RISK SHOULD YOU TAKE? Mark D. D'Antonio Nova Southeastern University FORT LAUDERDALE, FLORIDA, U.S.A. Abstract A successful retirement...

-

1. What is the expected return and standard deviation of a portfolio consisting of $2,500 invested in a risk-free asset with an 8-percent rate of return, and $7,500 invested in a risky security with...

-

MCQ questions: 1. An increase in oil prices, such as the oil shocks in the 70s, lead to _______ thereby causing ________ a movement along the AS curve; cost-push inflation a leftward shift in the AS...

-

A closely wound solenoid of 2000 turns and area of cross-section 1.5 x 10 mcarries a current of 2.0 A. It suspended through its centre and perpendicular to its length, allowing it to turn in a...

-

For each of the following controls, identify whether the control leaves a paper audit trail. Also identify a test of control audit procedure the auditor can use to test the effectiveness of the...

-

For the following exercises, write the first five terms of the geometric sequence. a n = 4 5 n 1

-

The birthday problem. A famous example in probability theory shows that the probability that at least two people in a room have the same birthday is already greater than 1/2 when 23 people are in the...

-

Company A has three debt issues of $3,000 each. The interest rate on issue A is 4 percent, on B the rate is 6 percent, and on C the rate is 8 percent. Issue B is subordinate to A, and issue C is...

-

That old equipment for producing oil drums is worn out" said Bill Seebach, president of Hondrich Company, "We need to make a decision quickly. The company is trying to decide whether it should rent...

-

As the correlation coefficient between two securities changes in a portfolio, a. both expected return and risk change. b. neither expected return nor risk changes. c. only risk changes.

-

Stocks A and B have standard deviations of 8% and 15%, respectively. The correlation between the two stocks returns has historically been 0.35. What is the standard deviation of a portfolio...

-

How is counterparty risk mitigated in a currency futures contract? Explain how the daily marking to market of currency futures reduces the risk of trading this derivative.

-

Share your thoughts on the descriptions of coaching versus mentoring. Discuss which technique you personally find more helpful, incorporating your peers' example scenarios if possible. Provide...

-

Hanung Corp has two service departments, Maintenance and Personnel. Maintenance Department costs of $380,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of...

-

Discuss difference between nominal interest rate and real interest rate. Explain why real interest rate is more important than the nominal interest rate using your answer to Question 1 of the...

-

Refer to Figure 14-1. How would an increase in the money supply move the economy in the short and long run?

-

1) Special Relativity. Statement: Imagine this situation: Alice stands in New York City while Bob, aboard a plane departing from Boston, directly crosses over Alice at t=0. Disregard the vertical...

-

Why do you think Zappos is not outsourcing its call centers?

-

A non-charmed baryon has strangeness S = 2 and electric charge Q = 0. What are the possible values of its isospin I and of its third component I z ? What is it usually called if I = 1/2?

-

Sociology

-

I am unsure how to answer question e as there are two variable changes. In each of the following, you are given two options with selected parameters. In each case, assume the risk-free rate is 6% and...

-

On January 1, Interworks paid a contractor to construct a new cell tower at a cost of $850,000. The tower had an estimated useful life of ten years and a salvage value of $100,000. Interworks...

Study smarter with the SolutionInn App