A share of stock will pay a dividend of ($1.00) one year from now, with dividend growth

Question:

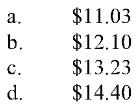

A share of stock will pay a dividend of \($1.00\) one year from now, with dividend growth of 5 percent thereafter. In the context of a dividend discount model, the stock is correctly priced at \($10\) today. According to the constant dividend growth model, if the required return is 15 percent, what should the value of the stock two years from now?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: