a. What are some possible reasons why individual investors might prefer to buy Treasury STRIPS rather than

Question:

a. What are some possible reasons why individual investors might prefer to buy Treasury STRIPS rather than common stocks?

b. What are some possible reasons why individual investors might prefer to buy individual Treasury STRIPS rather than whole T-notes or T-bonds?

c. For zero coupon bonds with the same face value and yield to maturity, is the price of a zero with a 15-year maturity larger or smaller than the average price of two zeroes with maturities of 10 years and 20 years? Why?

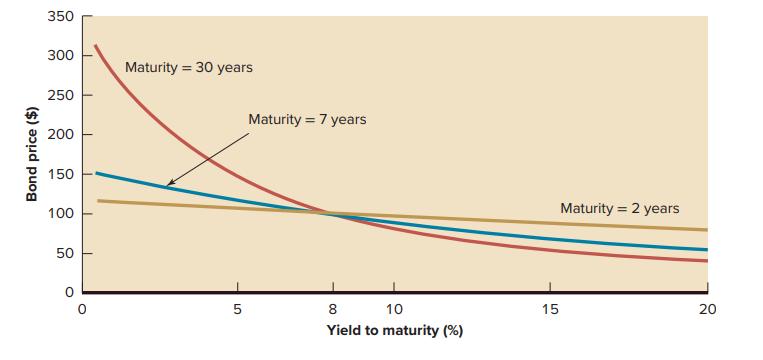

d. What would Figure 18.5 look like if the three bonds all had coupon rates of 6 percent? What about 10 percent?

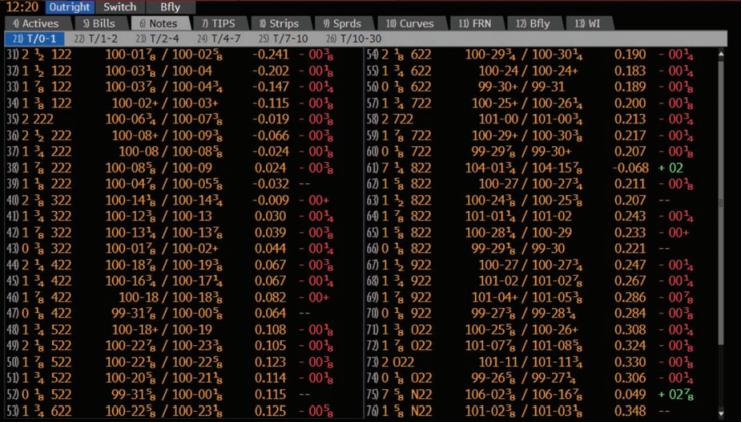

e. In Figure 18.4, which Treasury issues have the narrowest spreads? Why do you think this is so?

f. Examine the spreads between bid and ask prices for Treasury notes and bonds listed online at www.wsj.com.

Figure 18.4:

Figure 18.5:

Step by Step Answer:

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin