Mega Marketing, an advertising firm specializing in the financial services industry, has just hired Kinara Yamisaka. Ms.

Question:

Mega Marketing, an advertising firm specializing in the financial services industry, has just hired Kinara Yamisaka. Ms. Yamisaka was a finance major in college and is a candidate for the CFA program. She was hired to provide the firm with more depth in the area of investment performance analysis.

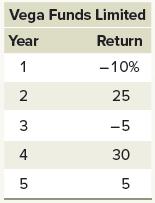

Mega is preparing advertising information for Vega Funds Limited. Vega has provided the following five-year annual return data, where Year 5 is the most recent period:

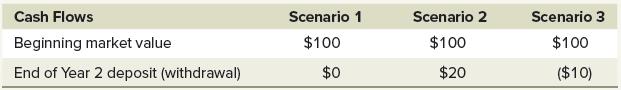

To assess her understanding of returns, Ms. Yamisaka’s supervisor asks her to calculate a number of different returns, including arithmetic, geometric, annualized, and money- (or dollar-)weighted returns. He also asks her to determine the impact of the following cash flow scenarios on Vega’s returns:

1. What is Vega’s geometric average return over the five-year period?

a. 7.85 percent

b. 9.00 percent

c. 15.14 percent

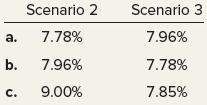

2. What are Vega’s money- (or dollar-)weighted average returns over the five-year period for Scenarios 2 and 3?

3. Ms. Yamisaka has determined that the average monthly return of another Mega client was 1.63 percent during the past year. What is the annualized rate of return?

a. 5.13 percent

b. 19.56 percent

c. 21.41 percent

4. The return calculation method most appropriate for evaluating the performance of a portfolio manager is:

a. Holding period.

b. Geometric.

c. Money-weighted (or dollar-weighted).

Step by Step Answer:

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin