Suppose we had the following projections on three stocks: We want to calculate portfolio expected returns in

Question:

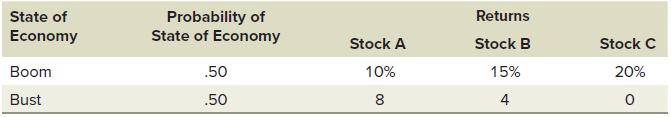

Suppose we had the following projections on three stocks:

We want to calculate portfolio expected returns in two cases. First, what would be the expected return on a portfolio with equal amounts invested in each of the three stocks? Second, what would be the expected return if half of the portfolio were in A, with the remainder equally divided between B and C?

Transcribed Image Text:

State of Economy Boom Bust Probability of State of Economy .50 .50 Stock A 10% 8 Returns Stock B 15% 4 Stock C 20% 0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (8 reviews)

From our earlier discussion the expected returns on the individual stocks are ER A 90 ER B 95 ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted:

Students also viewed these Business questions

-

Write a Java program to compute the sum of the first 100 prime numbers Sample Output: Sum of the first 100 prime numbers: 24133

-

Describe market equilibrium using relevant graphs and discuss market surplus and market shortage.?

-

In Example 11.3, what are the standard deviations of the two portfolios? Example 11.3 Suppose we had the following projections on three stocks: We want to calculate portfolio expected returns in two...

-

1. What options does Personal Trainer have for developing a new system? What are some specific issues and options that Susan should consider in making a decision? 2. Susan has been asked to prepare a...

-

Gallium arsenide (GaAs) and gallium phosphide (GaP) both have the zinc blende crystal structure and are soluble in one another at all concentrations. Determine the concentration in weight percent of...

-

The rim of a flywheel has the cross section A-A shown. Determine the volume of material needed for its construction. Given: r = 300 mm a = 20 mm b = 40 mm c = 20 mm d = 60 mm Section A-A

-

Describe factors that affect: a. schedule feasibility. b. technical feasibility. c. organizational feasibility.

-

aA scientist claims that pneumonia causes weight loss in mice. The table shows the weights (in grams) of six mice before infection and two days after infection. At = 0.01, is there enough evidence...

-

4. [30 Points] A random variable y is related to (dependent on) three other random variables 2, z and w. Data on y, t, z and w is collected for a random sample of n individuals (i = 1, ...., n)....

-

On September 1, 2024, a company decides to lease office space in a building. The buildings owner offers the company the following options, with the first monthly payment beginning September 30, 2024:...

-

Jpod experiences returns of 0 percent, 25 percent, or 50 percent, each with a one-third probability. What is the approximate return standard deviation for Jpod? a. 30 percent b. 25 percent c. 20...

-

Review the correlation of Walmart (WMT) relative to its peers.

-

How will the creation of such standards help a business or organization?

-

How do we design an electromagnetic sensor?

-

What is a virtual breadboard?

-

Joe secured a loan of $13,000 four years ago from a bank for use toward his college expenses. The bank charges interest at the rate of 9%/year compounded monthly on his loan. Now that he has...

-

Answer these two questions 1 32 2 Number of Units Sold 3 4 ! Direct Material units per unit of production 5 i 6 Total Direct Materials Used 7! 8 Price Per Unit 9 10 Cost of Direct Materials 11 12 13...

-

Give an algorithm for converting a tree to its mirror. Mirror of a tree is another tree with left and right children of all non-leaf nodes interchanged. The trees below are mirrors to each other....

-

A temperature difference of 85C is impressed across a fiberglass layer of 13 cm thickness. The thermal conductivity of the fiberglass is 0.035W/mC. Compute the heat transferred through the material...

-

The area of a rectangle is 30 cm 2 and its perimeter is 26 cm. Find the length and width of the rectangle.

-

A share of stock sells for $35 today. The beta of the stock is 1.2, and the expected return on the market is 12 percent. The stock is expected to pay a dividend of $.80 in one year. If the risk-free...

-

What are the Sharpe and Treynor ratios for the fund? You have been given the following return information for a mutual fund, the market index, and the risk free rate. You also know that the return...

-

Calculate Jensen's alpha for the fund, as well as its information ratio. You have been given the following return information for a mutual fund, the market index, and the risk free rate. You also...

-

What is the risk profile of your company? (How much overall risk is there in this firm? Where is this risk coming from (market, firm, industry or currency)? (APPLE COMPANY LATEST DATA) How is the...

-

What is the duration for the following bond with annual payments? 5.6300 5.7957 4.9894 5.1910 5.3806

-

DOLLAR TREE GROCERY OUTLET Short-Term Liquidity 2021 2022 2021 2022 Current Ratio 1.35 1.51 1.86 1.67 Quick Ratio 0.24 0.15 0.63 0.42 Cash Ratio Cash Conversion Cycle 34.78 45.75 19.41 21.61 Days...

Study smarter with the SolutionInn App