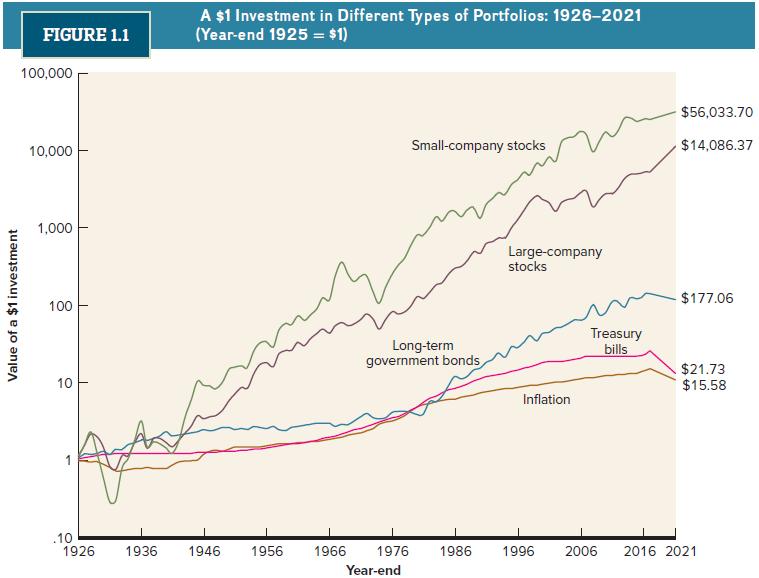

Take a look back at Figure 1.1, which showed the value of a $1 investment after 96

Question:

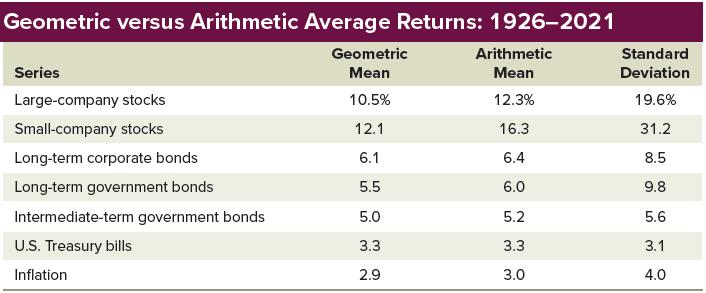

Take a look back at Figure 1.1, which showed the value of a $1 investment after 96 years. Use the value for the small-company stock investment to check the geometric average in Table 1.5.

Figure 1.1

Table 1.5

Transcribed Image Text:

Value of a $1 investment FIGURE 1.1 100,000 10,000 1,000 100 10 .10 1926 1936 A $1 Investment in Different Types of Portfolios: 1926-2021 (Year-end 1925 = $1) 1946 1956 Small-company stocks Long-term government bonds 1966 1976 Year-end Large-company stocks Inflation 1986 1996 Treasury bills $56,033.70 $14,086.37 -$177.06 $21.73 $15.58 2006 2016 2021

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

In Figure 11 the smallcompany investment grew to 560337...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Investments Valuation And Management

ISBN: 9781266824012

10th Edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted:

Students also viewed these Business questions

-

Take a look back at Figure 10.4. There we showed the value of a $1 investment after 95 years. Use the value for the large-company stock investment to check the geometric average in Table 10.3. Table...

-

Take a look back at Figure 20.1 to answer the following questions: a. If you have $100, how many euros can you get? b. How much is one euro worth? c. If you have five million euros, how many dollars...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Selected data on merchandise inventory, purchases, and sales for Jaffe Co. and Coronado Co. are as follows: Instructions 1. Determine the estimated cost of the merchandise inventory of Jaffe Co. on...

-

(a) Verify that Equation 16.11, the expression for the fiber load???matrix load ratio (Ff/Fm), is valid. (b) What is the Ff/Fc ratio in terms of Ef, Em, andVf? E,V, F EV F, (16.11)

-

If each cord can sustain a maximum tension of T before it fails, determine the greatest weight of the flowerpot the cords can support. Given: T = 50 N θ1 = 30 deg θ2 = 30 deg θ3 =...

-

What kind of orientation training will you give new employees? AppendixLO1

-

When Teris outside basis in the TMF Partnership is $80,000, the partnership distributes to her $30,000 cash, an account receivable (fair market value of $60,000, inside basis to the partnership of...

-

Assuming the bond is selling to yield 5.25%, compute the duration basd on a 25 basis point rate shock: Yield Coupon rate 5%, 25 year maturity 5.00% 1,000 5.25% 960 5.50% 945

-

On December 31, 20X0, Toms River Rafting, Inc. (TRR), has a deferred tax asset related to a $250,000 net operating loss carryforward. The enacted tax rate (and substantively enacted tax rate) at the...

-

You want to buy 1,000 shares of Devon Energy (DVN) at a price of $48 per share. You put up $36,000 and borrow the rest. What does your account balance sheet look like? What is your margin?

-

Calculate the geometric average return for the large-company stocks for the years 20122015 in Table 1.1. Table 1.1 Year 1926 1927 1928 1929 1930 1931 1932 1933 1934 1935 1936 1937 1938 1939 1940 1941...

-

The net single premium for a five-year term policy at age 35 is $4.87 (2001 CSO table, female lives, 4 percent interest assumption). Why can we not compute the annual premium for a five-year term...

-

Absorption linewidth for an absorbing atomic transition. Consider the curves of power transmission T(w) = exp[-2am(w)L] through an atomic medium with a lorentzian resonant transition, plotted versus...

-

EXAMPLE 05.04 Z Write the force and the couple in the vector form (with rectangular/Cartesian components). Use C = 180 N-m and P = 500 N O INDIVIDUAL Submission (IS12) D x 400 mm B C 300 mm A 400 mm...

-

1.XYZ Corporation budgets factory overhead cost of P500,000 for the coming year. Compute for the overhead cost applied to the job. The following data are available: Budgeted annual overhead for...

-

OP Technologies Manufacturing manufactures small parts and uses an activity-based costing system. Activity Materials Assembling Packaging Est. Indirect Activity Costs $65,000 $242,000 $90,000...

-

3. Solve Example 3.7 (Bergman, Lavine, Incropera, and DeWitt, 6th Ed., pp. 129-132, or 7th Ed., pp. 145-149, or 8th Ed., pp. 134-138), but use the finite difference method. T T = 30C Insulation-...

-

A rod of length L has one end maintained at temperature T0 and is exposed to an environment of temperature T. An electrical heating element is placed in the rod so that heat is generated uniformly...

-

Which of the following gives the range of y = 4 - 2 -x ? (A) (- , ) (B) (- , 4) (C) [- 4, ) (D) (- , 4] (E) All reals

-

You own stock in a company that has just initiated employee stock options. How do the employee stock options benefit you as a shareholder?

-

In general, employee stock options cannot be sold to another party. How do you think this affects the value of an employee stock option compared to a market-traded option?

-

What is the value of a call option if the underlying stock price is $108, the strike price is $105, the underlying stock volatility is 47 percent, and the risk-free rate is 4 percent? Assume the...

-

During 2024, its first year of operations, Hollis Industries recorded sales of $11,900,000 and experienced returns of $760,000. Cost of goods sold totaled $7,140,000 (60% of sales). The company...

-

What is the value of a 15% coupon bond with 11% return? Is it a discount or a premium bond?

-

A manufacturer with a December 31 taxation year end sells new machinery for $50,000 on January 2, 2022. The cost of the machinery is $20,000. The terms of the sale require an initial payment of...

Study smarter with the SolutionInn App