You are attempting to do a leveraged buyout of Boston Turkey but have run into some roadblocks.

Question:

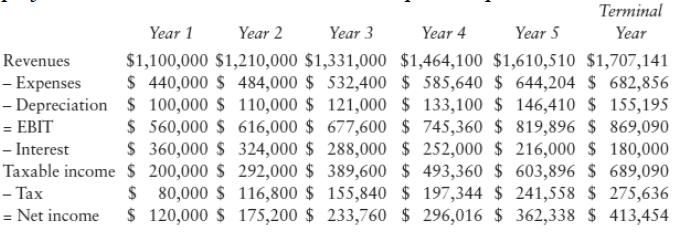

You are attempting to do a leveraged buyout of Boston Turkey but have run into some roadblocks. You have some partially completed projected cash flow statements and need help to complete them.

The capital expenditures are expected to be \($120,000\) next year and to grow at the same rate as revenues for the rest of the period. Working capital will be kept at 20% of revenues (revenues this year were \($1\) million).

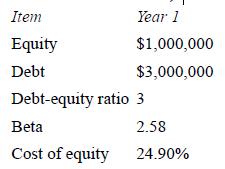

The leveraged buyout will be financed with a mix of \($1\) million of equity and \($3\) million of debt (at an interest rate of 12%). Part of the debt will be repaid by the end of year 5, and the debt remaining at the end of year 5 will remain on the books permanently.

a. Estimate the cash flows to equity and the firm for the next five years.

b. The cost of equity in year 1 has been computed. Compute the cost of equity each year for the rest of the period (use book value of equity for the calculation).

c. Compute the terminal value of the firm.

d. Evaluate whether the leveraged buyout will create value.

Step by Step Answer:

Investment Valuation Tools And Techniques For Determining The Value Of Any Asset

ISBN: 9781118011522

3rd Edition

Authors: Aswath Damodaran