You are examining the performance of two mutual funds. AD Value Fund has been in existence since

Question:

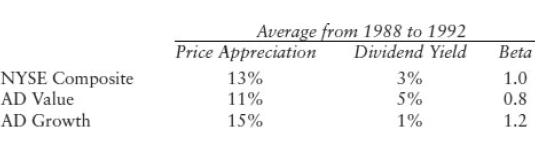

You are examining the performance of two mutual funds. AD Value Fund has been in existence since January 1, 1988, and invests primarily in stocks with low price-earnings ratios and high dividend yields. AD Growth Fund has also been in existence since January 1, 1988, but it invests primarily in high-growth stocks, with high PE ratios and low or no dividends. The performance of these funds over the past five years is summarized as follows:

The average risk-free rate during the period was 6%. The current risk free rate is 3%.

a. How well or badly did these funds perform after adjusting for risk?

b. Assume that the front-end load on each of these funds is 5% (i.e., if you put \($1,000\) in each of these funds today, you would only be investing \($950\) after the initial commission). Assume also that the excess returns you have calculated in part

(a) will continue into the future and that you choose to invest in the fund that outperformed the market. How many years would you have to hold this fund to break even?

Step by Step Answer:

Investment Valuation Tools And Techniques For Determining The Value Of Any Asset

ISBN: 9781118011522

3rd Edition

Authors: Aswath Damodaran