The Cross Oil Corporation incurred the following costs and had the following other transactions for the years

Question:

The Cross Oil Corporation incurred the following costs and had the following other transactions for the years 2015 and 2016. The company uses the successful efforts method of accounting.

2015

a. Paid $100,000 for G&G costs during the year.

b. Leased acreage in three individually significant areas as follows:

1) Jones lease—1,000 acres @ $60 per acre bonus, and other acquisition costs of

$3,000 2) Batch lease—800 acres @ a lease bonus of $70 per acre, and other acquisition costs of $10,000 3) Highland lease—600 acres @ $60 per acre bonus, and other acquisition costs of $8,000

c. The company also leased 20 individual tracts for a total cost of $80,000. These leases are considered to be individually insignificant and are the first insignificant unproved properties acquired by Cross.

d. Paid $5,000 in costs to maintain lease and land records in 2015. Also, paid $30,000 to successfully defend a title suit concerning the Batch lease.

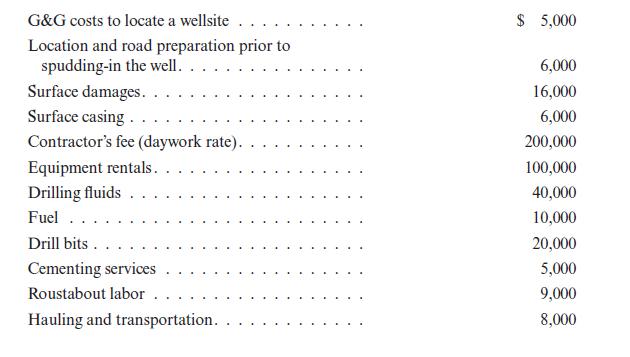

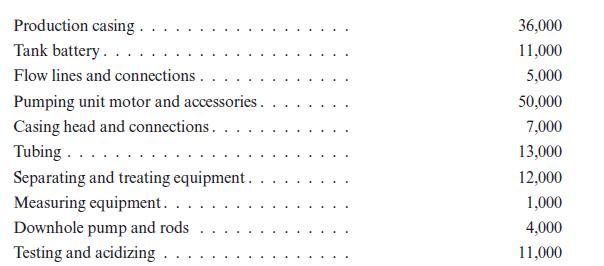

e. Paid the following costs in connection with Batch #1, a successful well:

f. An exploratory well was drilled on the Highland lease in 2015 on a turnkey basis to 8,000 feet. The contractor’s charge of $400,000 was paid. The charge included $60,000 for casing. At the end of 2015, a decision had not been made to complete or abandon the well. Both criteria for delaying classification of the well were met.

At the end of 2015, the Jones lease was impaired 60%, and the Highland lease by 30%. The company’s policy is to maintain an allowance for impairment at 70% of the cost of insignificant leases.

2016

a. Delay rentals of $2,000 were paid on the Jones lease, $1,200 on the Highland lease, and $3,000 on insignificant leases.

b. During 2016, the Jones lease was abandoned, and three of the individually insignificant leases (cost $8,000) were also abandoned. The Highland lease is now considered to be a very valuable lease, because a large producer was discovered on adjoining land.

c. At year-end (2016), the company had not made a decision to complete or abandon the Highland well. Both criteria for delaying classification of the well were no longer met.

REQUIRED: Prepare journal entries for the Cross Oil Corporation's transactions.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9781593701376

5th Edition

Authors: Charlotte J. Wright, Rebecca A. Gallun