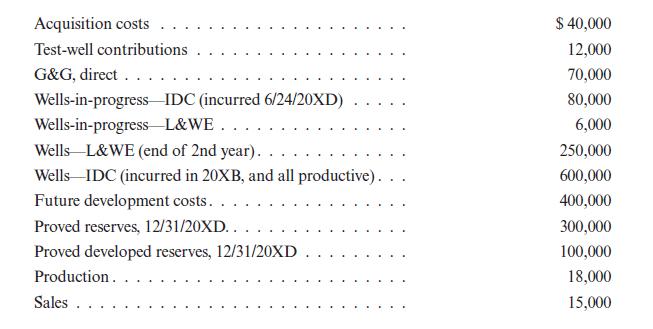

Tiger Energy owns only one lease in the United States, Lease Q. The following information for Lease

Question:

Tiger Energy owns only one lease in the United States, Lease Q. The following information for Lease Q, which is burdened with a 1/6 royalty, is as of 12/31/20XD. All reserve, production, and sales data apply only to Tiger Energy.

Additional data: Tiger also placed in service on 8/1/20XB a building that cost $140,000 and has a life of 10 years, with a salvage value of $9,000. The building houses the corporate headquarters that supports oil and gas operations in the United States and non–oil and gas operations in Canada. The operations conducted in the building are general in nature and are not directly attributable to any specific exploration, development, or production activity. Since the building is not directly related to exploration, development, or production and supports activities in more than one cost center, it is depreciated using straight-line depreciation for financial accounting.

Compute DD&A for 20XD for the following accounting methods.

a. Tax: assuming Tiger is an independent producer (ignore percentage depletion) and accumulated depletion is $10,000. Use proved reserves to compute cost depletion.

b. Tax: assuming Tiger is an integrated producer and accumulated depletion is $10,000. Use proved reserves to compute cost depletion.

c. Successful efforts: assuming accumulated DD&A—proved properties is $5,000;

accumulated DD&A—wells is $100,000.

d. Full cost: assuming exclusion of all possible costs from the amortization base.

Assume accumulated DD&A is $400,000.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9781593701376

5th Edition

Authors: Charlotte J. Wright, Rebecca A. Gallun