Tiger Oil began operations on January 1, 20XA. Assume the following facts about Tigers first two years

Question:

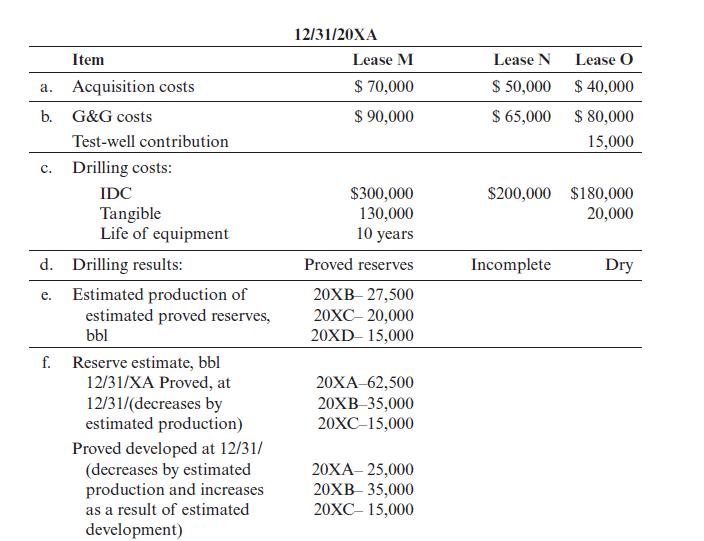

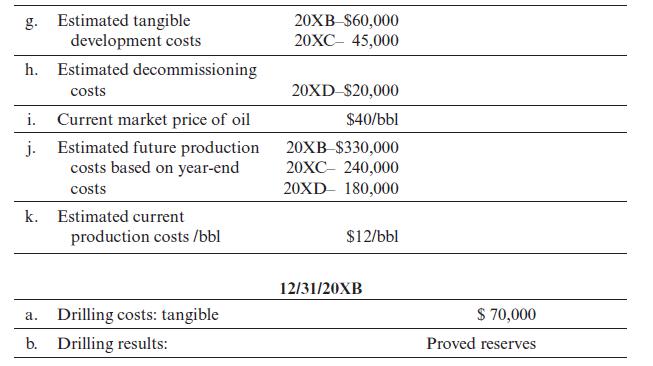

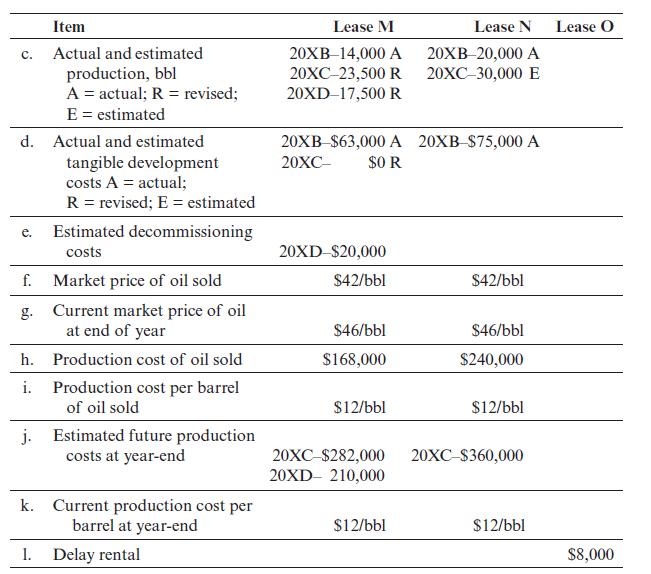

Tiger Oil began operations on January 1, 20XA. Assume the following facts about Tiger’s first two years of operations. All reserve and production quantities apply only to Tiger Oil’s interest. Ignore the computations for future income tax.

Assume a tax rate of 40% and that Tiger does not qualify for percentage depletion because it is an integrated producer. Ignore deferred taxes and the alternative minimum tax.

a. Prepare the required disclosures under SFAS No. 69, assuming Tiger is a successful efforts company.

b. Assume instead that Tiger is a full cost company that amortizes all possible costs.

Prepare only those disclosures that would differ under full cost compared to successful efforts.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9781593701376

5th Edition

Authors: Charlotte J. Wright, Rebecca A. Gallun