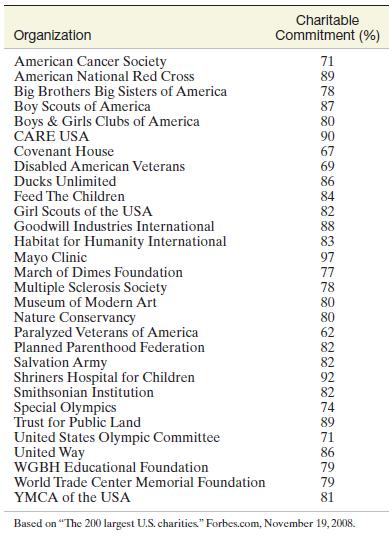

118 Tax-exempt charities. Donations to tax-exempt organizations such as the Red Cross, the Salvation Army, the YMCA,

Question:

118 Tax-exempt charities. Donations to tax-exempt organizations such as the Red Cross, the Salvation Army, the

YMCA, and the American Cancer Society not only go to the stated charitable purpose, but are used to cover fundraising expenses and overhead. The CHARITY file contains the charitable commitments (i.e., the percentage of expenses that goes toward the stated charitable purpose)

for a sample of 30 charities.

a. Give a point estimate for the mean charitable commitment of tax-exempt organizations.

b. Construct a 95% confidence interval for the mean charitable commitment.

c. What assumption(s) must hold for the method of estimation used in part b to be appropriate?

d. Why is the confidence interval of part b a better estimator of the mean charitable commitment than the point estimator of part a ?

*e. Constract a 95% confidence interval for the variance in charitable commitments for all tax-exempt organizations.

Step by Step Answer: