Allie contributed the following business assets to ASW Partnership on August 1, 2021: What is the holding

Question:

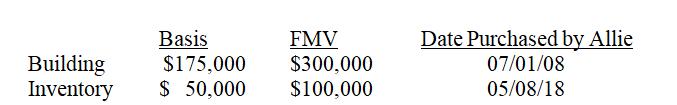

Allie contributed the following business assets to ASW Partnership on August 1, 2021:

What is the holding period for the building and the inventory to ASW Partnership?

a. Building – long-term capital or § 1231 asset.

b. Building – short-term ordinary asset.

c. Inventory – short-term ordinary asset.

d. Both a and c.

Transcribed Image Text:

Basis $175,000 Building Inventory $ 50,000 FMV $300,000 $100,000 Date Purchased by Allie 07/01/08 05/08/18

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

d ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Taxation 2022

ISBN: 9781264209408

15th

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander

Question Posted:

Students also viewed these Business questions

-

Allie contributed the following business assets to ASW Partnership on August 1, 2017: What is the holding period for the building and the inventory to ASW Partnership? a. Building long-term capital...

-

1. Allie contributed the following business assets to ASW Partnership on August 1, 2015: What is the holding period for the building and the inventory to ASW Partnership? a. Building - long-term...

-

Multiple Choice Questions 1. Carmin performs services in exchange for a 25% interest in Real Estate Rental Partnership. The services were worth $15,000. The tax implications to Carmin are: a. No...

-

Liberty Ventures Inc. reported a $320,000 profit in 2020 and declared preferred dividends of $20,000. The following changes in common shares outstanding occurred during the year: Jan 1 100,000 common...

-

What is the difference between a defined benefit plan and a defined contribution plan? What are the advantages and disadvantages of each?

-

In 1994 Texaco reported net income of $910 million, $494 million of which was income rec ognized on investments in affiliate companies accounted for under the equity method. In that same year Texaco...

-

From the following information calculate margin of safety: Year 2006 2007 P/V Ratio 25% 30% Profit Rs. 75,000 Rs. 1,20,000 [Ans.: (1) For 2006-Rs. 3,00,000, (2) For 2007-Rs. 4,00,000]

-

Foz Co. is considering four investment proposals (A, B, C, and D). The following table provides data concerning each of these investments: Solve for the missing information pertaining to each...

-

1) A loan of $77,000 is repaid by payments of $3,000 at the end of every month. Interest is 6% compounded monthly. (4 total-Ch14) (a) How many payments are required to repay the debt? (2 marks) (b)...

-

Costs for Decision Making: An Instructional Case of Relevant Costs and Differential Analysis of Cost Reduction Alternatives. I have a PDF of the case study, CASE QUESTIONS Provide responses,...

-

Calvin purchased a 40% partnership interest for $43,000 in February 2019. His share of partnership income in 2019 was $22,000, in 2020 was $25,000, and in 2021 was $12,000. He made no additional...

-

Sofia contributed the following business assets to S & S Partnership on March 3, 2021: What is the basis in the equipment and the accounts receivable to S&S? a.Equipment $0;Accounts Receivable $ 0....

-

The City of Allentown recently received a donation of two items: 1. A letter written in 1820 from James Allen, the towns founder, in which he sets forth his plan for the towns development....

-

Childhood leukemia, a hematological malignancy, is the most common form of childhood cancer, representing 29% of cancers in children aged 0 to 14 years in 2018. Imagine that you work in the State...

-

Question 1 Approximating functions using linear functions or higher degree polynomials is a very useful scientific tool! This concept generalizes to Taylor Polynomials, but is most simply illustrated...

-

Find the volume of the solid of revolution formed by rotating the specified region R about the x axis. Volume Formula Suppose f(x) is continuous and f(x) 0 on a x b, and let R be the region under the...

-

As machines get older, the cost of maintaining them tends to increase. Suppose for a particular machine, the rate at which the maintenance cost is increasing is approximated by the function C' (t) =...

-

At Edsel Automotive, the management team is planning to expand one of its plants by adding a new assembly line for sport utility vehicles (SUVs). The cost of setting up the new SUV assembly line is...

-

Suppose we want to compare the observed and expected number of events among the group with <250 treatments. Perform an appropriate significance test, and report a two-tailed p-value? Cancer The...

-

Solve each problem. Find the coordinates of the points of intersection of the line y = 2 and the circle with center at (4, 5) and radius 4.

-

What is the difference between a deductible repair expense and a capital improvement of a rental property?

-

Ramone is a tax attorney and he also owns an office building that he rents for $8,500/month. He is responsible for paying all taxes and expenses relating to the buildings operation and maintenance....

-

Kelvin owns and lives in a duplex. He rents the other unit for $750 per month. He incurs the following expenses during the current year for the entire property: Mortgage interest $7,500 Property...

-

*Prepare the plant assets section of Amphonie's balance sheet at December 31, 2021 using the information below. At December 31, 2020, Amphonie Company reported the following as plant assets. Land $...

-

Question 1 of 1 - / 100 View Policies Current Attempt in Progress Pargo Company is preparing its budgeted income statement for 2020. Relevant data pertaining to its sales, production, and direct...

-

Schopp Corporation makes a mechanical stuffed alligator that sings the Martian national anthem. The following information is available for Schopp Corporation's anticipated annual volume of 500,000...

Study smarter with the SolutionInn App