Felicia, who is single, received support from the following individuals and sources during the current year: Which

Question:

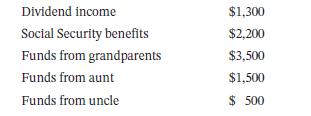

Felicia, who is single, received support from the following individuals and sources during the current year:

Which of these individuals may claim Felicia as a dependent under a multiple support agreement?

Transcribed Image Text:

Dividend income $1,300 Social Security benefits $2,200 Funds from grandparents $3,500 Funds from aunt $1,500 Funds from uncle $ 500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

The grandparents or the aunt can claim Felicia as a dependent on their tax returns under a multipl...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Taxation For Individuals A Practical Approach 2024

ISBN: 9781119744191

1st Edition

Authors: Gregory A Carnes, Suzanne Youngberg

Question Posted:

Students also viewed these Business questions

-

Question: Old MathJax webview Old MathJax webview i need ans of these question but the source is alot Old MathJax webviewOld MathJax webview i need ans of these question but the source is alot these...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

The taxpayers, George A. Warden (social security number 333-33-3330) and Mary S.Warden (social security number 444-44-4440) file a joint return. Both are 50 years old,have good eyesight, and live...

-

Bilboa Freightlines, S.A., of Panama, has a small truck that it uses for intracity deliveries. The truck is worn out and must be either overhauled or replaced with a new truck. The company has...

-

Sophia and Jacob are married and file a joint return. The return for 2015 included a Form 2106 for each of them. The return for 2016, however, included a Form 2106 and a Schedule C. In terms of...

-

Use the graph to determine the domain and range of the given function. Fig. 3.24(a) y 4 0 3-2-1 0 1 2 3 -2 -3 (a) 3/4 $ X

-

Understand corporate social responsibility, sustainability, and the crisis of global poverty. LO.1

-

1. How has Warren Brown been able to finance the growth of his company? 2. What methods has Cake Love used to manage cash flow? What others might they adopt? 3. What types of cash flow management...

-

The primo Company had total payroll of $230702.97 for first quarter of the current year. It withheld $24830.95 from the employees gorvfederal income tax during this quarter.The company made the...

-

Ramada Company produces one golf cart model. A partially complete table of company costs follows: Required: 1. Complete the table. 2. Ramada sells its carts for $1,200 each. Prepare a contribution...

-

A.J. and Claire were married five years ago and filed a joint tax return in each year. In the current year, the couple filed for divorce, which was finalized on December 30. The couple does not have...

-

Kobe is single and has two children, Trent, age 18, and Garret, age 21. Both sons attend college. Trent attended college from August through December of the current year. Garret attended college from...

-

Many millionaires continue to work long, hard hours, sometimes even beyond the usual age of retirement. Use the ideas developed in the chapter to speculate about the reasons for this motivational...

-

Service provides commercial and industrial appraisals and feasibility studies. On January 1 , the assets and liabilities of the business were the following: Cash, \(\$ 8,700\); Accounts Receivable,...

-

Sketch the mapping of the value chain for: a A consulting firm b An airline c A trading firm d A corporate and investment bank e An internet-based platform (e.g. Airbnb, Netflix)?

-

Red River Banking Company has ten automatic i) AND teller machines (ATMs) spread throughout the city maintained by the ATM Department. You have been assigned the task of determining the cost of...

-

Super Day Spa provided \(\$ 120,000\) of services during 2012. All customers paid for the services with credit cards. Super submitted the credit card receipts to the credit card company immediately....

-

The following data represent the height of 26 statistics students as measured in inches: a. Create a frequency table for these data. b. Create a histogram for these data with an interval width of 1...

-

Use the decomposition principle to solve the Wyndor Glass Co. problem presented in Sec. 3.1.

-

Describe basic managerial approaches to implementing controls and how these are implemented.

-

As a long-term investment at the beginning of the 2018 fiscal year, Florists International purchased 25% of Nursery Supplies Inc.'s 18 million shares for $66 million. The fair value and book value of...

-

Javier is currently paying $1,200 in interest on his credit cards annually. If, instead of paying interest, he saved this amount every year, how much would he accumulate in a tax-deferred account...

-

Your company is considering the purchase of a fleet of cars for $195,000. It can borrow at 6%. The cars will be used for four years. At the end of four years they will be worthless. You call a...

Study smarter with the SolutionInn App