Harry and Sally Wentz, ages 35 and 34 respectively, have been married for ten years and have

Question:

Harry and Sally Wentz, ages 35 and 34 respectively, have been married for ten years and have two children, Henry and Sandy, ages 4 and 3 respectively.

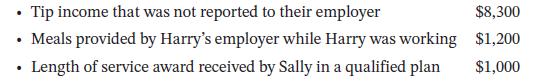

Both Harry and Sally work and the children are in daycare. Besides W-2- and 1099R-reported income, Harry and Sally have the following income:

Harry took a distribution from his company’s retirement plan of \($20,000.\) \($6,000\) was rolled over into another qualified retirement plan, \($10,000\) was used towards a down payment on a home (this is the first home that Harry and Sally have purchased), and \($4,000\) was used to pay off high interest rate credit cards.

You will review provided W-2s and 1099R, and calculate: the taxable portion for dependent care assistance;

Harry and Sally’s gross income; and the premature distribution penalty.

Step by Step Answer:

Fundamentals Of Taxation For Individuals A Practical Approach 2024

ISBN: 9781119744191

1st Edition

Authors: Gregory A Carnes, Suzanne Youngberg