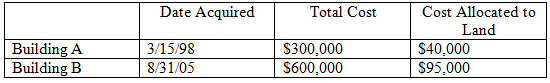

Herbie is the owner of two apartment buildings. ? Following is information related to the two buildings:

Question:

Herbie is the owner of two apartment buildings.?Following is information related to the two buildings:

Herbie elected the maximum depreciation available for each asset. What is the effect of depreciation on AMTI for 2019?

Transcribed Image Text:

Date Acquired Total Cost Cost Allocated to Land Building A Building B 3/15/98 8/31/05 $40,000 $300,000 S600,000 $95,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

Depreciable Cost Regular Tax A...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Fundamentals Of Taxation 2020 Edition

ISBN: 9781260483147

13th Edition

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander, Debra Prendergast, Dan Schisler

Question Posted:

Students also viewed these Business questions

-

The following transactions took place in the books of Freezer Stores during the month of June: : The monthly fee paid to a local insurance company was R5 250. The company bought inventory worth R10...

-

The owner of two submarine sandwich shops located in a particular city would like to know how the mean daily sales of the first shop (located in the downtown area) compares to that of the second shop...

-

Sara Shimizu is the owner of two rental properties, 509 Brunswick Avenue and 356 Spadina Road. These properties were purchased six years ago for $525,000 and $600,000, respectively. In 2012, 509...

-

Chuck, a single taxpayer, earns $86,000 in taxable income and $20,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an...

-

Solve the systems in exercises 1-2. 1. x2 + 5x3 = -4 x1 + 4x2 + 3x3 = -2 2x1 + 7x2 + x3 = -2 2. x1 - 5x2 + 4x3 = -3 2x1 - 7x2 + 3x3 = -2 -2x1 + x2 + 7x3 = -1

-

What are the economic and accounting differences between a derined-benefit pension plan and a delined-contribution plan?

-

Long-term memory is an archive of information about past experiences in our lives and knowledge we have learned, but it is important to consider the dynamic qualities as well, such as how LTM...

-

Antioch Extraction, which mines ore in Montana, uses a calendar year for both financial-reporting and tax purposes. The following selected costs were incurred in December, the low point of activity,...

-

Draw a graph of a firm making positive profits in an industry of Monopolistic Competition

-

THE SHOPPES AT RIVERSIDE Fonda L. Carter, Columbus State University Kirk Heriot, Columbus State University CASE DESCRIPTION This case asks the students to recommend a decision to a group of...

-

Clay Company uses the completed contract method on a contract that requires 14 months to complete. The contract is for $750,000, and has estimated costs of $425,000. At the end of 2019, $210,000 of...

-

William is not married, nor does he have any dependents. He does not itemize deductions. His taxable income for 2019 was $87,000 and his regular tax was $15,061. His AMT adjustments totaled $125,000....

-

Happy Rupert's Pets Ltd. has a November 30 year-end, and it began the year 2015 with the following balances: Retained Earnings .......................................$346,190 Accumulated Other...

-

Process P1 init (mutEx); num = 0; loop1 = 0; while (loop1 < 3) wait (mutEx); num num + 1; signal (mutEX); loop1 loop1 + 1; Process P2 loop2 = 0; while (loop2 < 2) wait (mutEx); num num + 10;...

-

PROBLEM 3-5B Following is the chart of accounts of Smith Financial Services: Assets 111 Cash 113 Accounts Receivable 115 Supplies 117 Prepaid Insurance 124 Office Furniture Liabilities 221 Accounts...

-

4. Identify a service you could refer Casey to and write a referral for her (up to 300 words).

-

Provide a brief bio of the leader and a brief overview of the change or crisis they led the organization or movement through. Discuss their leadership style during this change/crisis using one of the...

-

Write a C++ function named Ifsr that accepts feedback path and initial states as unsigned integers and the number of random bits to be printed as arguments. The function will print the random bits by...

-

Use the code shown in Figure 6-33 to answer What will the code in Figure 6-33 display when the id variable contains the character 9? a. Janet b. Jerry c. Mark d. Sue if (id -- '8') cout

-

An example of prescriptive analytics is when an action is recommended based on previously observed actions. For example, an analysis might help determine procedures to follow when new accounts are...

-

Determine the amount of tax liability in each of the following cases. a. Taxable income of $45,200. b. Taxable income of $450,200. c. Taxable income of $4,500,200. d. Taxable income of $14,500,200....

-

Determine taxable income in each of the following instances. Assume that the corporation is a C corporation and that book income is before any income tax expense. a. Book income of $50,000 including...

-

Using the information from Problem 54, calculate the amount of tax liability in each instance. In problem a. Book income of $50,000 including capital gains of $2,000, a charitable contribution of...

-

Not sure if what I have so far is right, answer everything please! Thank you. EcoSacks manufactures cloth shopping bags. The controller is preparing a budget for the coming year and asks for your...

-

Case # 2 Baltimore Wiper Blade Company, Inc. After extensive research and development, Baltimore Wiper Blade Co. (BWB), has developed a new automobile wiper blade, the Ever Clear wiper blade and must...

-

ework - REQUIRED H [The following information applies to the questions displayed below) During April, the first production department of a process manufacturing system completed its work on 300,000...

Study smarter with the SolutionInn App