Lauprechta Inc. has the following employees on payroll: Complete the table for taxes to be withhold for

Question:

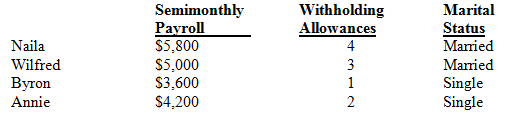

Lauprechta Inc. has the following employees on payroll:

Complete the table for taxes to be withhold for each pay period.

Employee |

Federal Withholding Tax |

Social Security Tax |

Medicare Tax |

Total Taxes Withheld? |

Naila |

||||

Wilfred |

||||

?Byron |

||||

?Annie |

Transcribed Image Text:

Withholding Marital Semimonthly Payroll $5,800 Allowances Status Married Married Single Single 4 3 Naila Wilfred Byron Annie $5,000 $3,600 $4,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

Employee Federal Withholding Tax Social Security Tax Medicare Tax Total Taxes Withheld Naila 66870 3...View the full answer

Answered By

Ashutosh Kourav

it was all exciting,challenging and also frustating sometimes in overall my previous learning journey.

in childhood not feel change in myself but impact of work on past is changes me more and feels that now.

still continuing my journey...

0.00

0 Reviews

10+ Question Solved

Related Book For

Fundamentals Of Taxation 2020 Edition

ISBN: 9781260483147

13th Edition

Authors: Ana Cruz, Michael Deschamps, Frederick Niswander, Debra Prendergast, Dan Schisler

Question Posted:

Students also viewed these Business questions

-

Lauprechta Inc. Company has the following employees on payroll: Semimonthly Payroll Withholding Allowances Marital Status Naila $ 5,800 4 Married Wilfred $ 5,000 3 Married Byron $ 3,200 1 Single...

-

Lauprechta Incorporated has the following employees on payroll. Assume that all the employees has only one job or that step 2 of Form W-4 is not checked and all dependents are under the age of 17....

-

Central Air Inc has the following transactions in August 2012. Prepare journal entries for each of the transactions: 1. Issued 3,000 shares common stock to investors for cash at $10 per share. 2....

-

Consider the following grooves, each of width W, that have been machined from a solid block of material. (a) For each case obtain an expression for the view factor of the groove with respect to the...

-

Use this fact (and no row operations) to find scalars c1, c2, c3, such that 153 153 456 730

-

Selecting an Independent Variable: Scatter Diagrams (LO2, 3) Peak Production Company produces backpacks that are sold to sporting goods stores throughout the Rocky Mountains. Presented is information...

-

Triangle Aluminum Company has the following data from 20x5 operations, which are to be used for developing 20x6 budget estimates: REVEmUS(OOOOOR MTS) an mattene eske eee canteirsc a ca $820,000...

-

Claudine Soosay recorded the following times assem-bling a watch. Determine (a) The average time, (b) The normal time, and (c) The standard time taken by her, using a performance rating of 95% and a...

-

he appropriate test to compare one sample to another sample to see if one is greater than another in some way is called a(n) _______. regression two-sample t-test of a difference in means one-sample...

-

Darin bought his fiancée Sarah a 3-carat diamond ring for $43,121 from Mandarin Gems. Later, Mandarin supplied Erstad with a written appraisal valuing the engagement ring at $45,500. Years...

-

Jacob Turner hired Jen Hatcher as a housekeeper starting on January 2 at $750 per month. Jacob does not withhold any federal taxes. Assume that Jen is not a housekeeper for anyone else. Assume Jacob...

-

Robertos salary is $133,200 in 2019. Roberto is paid on a semimonthly basis, is single, and claims one allowance. Use the percentage method table in the Appendix to this chapter. a. What is Robertos...

-

During 20X1, Schubert, Inc., earned revenues of $19 million from the sale of its products. Schubert ended the year with net income of $4 million. Schubert collected cash of $20 million from customers...

-

Using the Central Limit Theorem. In Exercises 5-8, assume that the amounts of weight that male college students gain during their freshman year are normally distributed with a mean of 1.2 kg and a...

-

Swain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city....

-

Please help Calculating NPV and IRR Businesses use NPV and IRR to determine whether a project will add - value for shareholders. After watching the CFA Level I Corporate Finance video, answer the...

-

Assume that John wants to annuitize the annuity and is told that he can receive a straight life annuity for $600 a month for life. If the actuarial number of payments is 300, how much of the first...

-

An epidemiologist plans to conduct a survey to estimate the percentage of women who give birth. How many women must be surveyed in order to be 90% confident that the estimated percentage is in error...

-

In this exercise, you will modify the savings account program shown earlier in Figure 9-18. Follow the instructions for starting C++ and viewing the Intermediate20.cpp file, which is contained in...

-

What are the key elements of a system investigation report?

-

Carson had the following itemized deductions in 2014: State income taxes $1,500 Charitable contributions. 9,900 Mortgage interest (personal residence) 12,000 Medical expenses [$8,000-(10%...

-

William is not married, nor does he have any dependents. He does not itemize deductions. His taxable income for 2014 was $87,000. His AMT adjustments totaled $125,000 (with the exception of the...

-

Herbie is the owner of two apartment buildings. Following is information related to the two buildings: Herbie elected the maximum depreciation available for each asset. What is the effect of...

-

The primary purpose of the cash budget is: Select one: a. To allow the firm to anticipate the need for outside funding b. To determine the collection pattern c. To determine monthly cash receipts d....

-

E1-1 Types of businesses Indicate whether each of the following companies is primarily a service, merchandise, or manufacturing business. If you are unfamiliar with the company, you may use the...

-

The country of Lebanon just invested $334,800 to build an amusement park. The amusement park is expected to produce cash inflows of $48,300 for 9 years and a cash inflow of $63,700 in Year 10. If...

Study smarter with the SolutionInn App