(Beginning balances, complete set of statements)} The December 31, 2004, postclosing trial balance of the General Fund...

Question:

(Beginning balances, complete set of statements)}

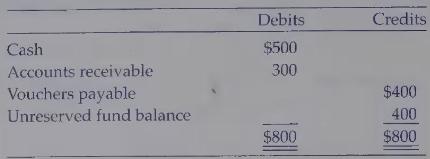

The December 31, 2004, postclosing trial balance of the General Fund of the City of Pompano was as follows:

a. The city council estimated revenues for FY 2004 to be $\$ 1,500$ and expenditures to be $\$ 1,450$.

b. The city's outstanding voucher payable, due to a contractor for remodeling city hall, was paid off in March.

c. Service charges of $\$ 800$ were collected during the year.

d. The Provo Bread Company paid the city $\$ 300$ it owed for repairs to a fire hydrant because of damage done by a runaway delivery truck.

e. Speeding tickets, which resulted in fines of $\$ 500$, were issued to tourists en route to Fun City. The fines were paid in cash.

f. Salaries of $\$ 1,000$ were paid to the mayor and the city clerk. Supplies costing $\$ 125$ were purchased for cash.

g. A used traffic light was purchased from the City of Clarkson for $\$ 150$, to be paid the following year.

Required: 1. Prepare journal entries to record the listed transactions in the General Fund.

2. Post these journal entries to the ledger. (Use T-accounts.)

3. Prepare a preclosing trial balance.

4. Prepare closing entries and post to the ledger.

5. Prepare a postclosing trial balance.

6. Prepare, in good form, a balance sheet and a statement of revenues, expenditures, and changes in fund balance.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch