(Determination of property tax rate) The legislative body of Pandorra County just approved the 2004-2005 fiscal year...

Question:

(Determination of property tax rate) The legislative body of Pandorra County just approved the 2004-2005 fiscal year budget. Revenues from property taxes are budgeted at $800,000. According to the county assessor, the assessed valuation of all of the property in the county is $50 million. Of this amount, however, property worth $10 mil-

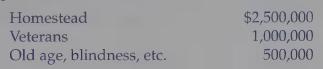

lion belongs to either the federal government or to religious organizations and, therefore, is not subject to property taxes. In addition, certificates for the following exemptions have been filed:

Homestead $2,500,000 Veterans 1,000,000 Old age, blindness, etc. 500,000 In the past, uncollectible property taxes averaged about 2 percent of the levy.

Homestead $2,500,000 Veterans 1,000,000 Old age, blindness, etc. 500,000 In the past, uncollectible property taxes averaged about 2 percent of the levy.

This rate is not expected to change in the foreseeable future.

Required: 1. Determine the property tax rate that must be used to collect the desired revenue from property taxes.

2. How much would the levy be on a piece of property that was assessed for $100,000 (after exemptions)?

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch