(Journal entries and financial statements for an Enterprise Fund) The following transactions relate to Walton City's Municipal...

Question:

(Journal entries and financial statements for an Enterprise Fund)

The following transactions relate to Walton City's Municipal Airport Fund for the fiscal year ended June 30, 2004:

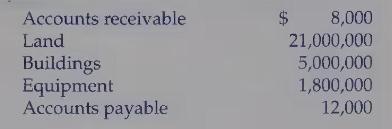

1. The General Fund made a permanent contribution of $\$ 3$ million for working capital to start a municipal airport. The city used part of that money, together with the proceeds from a $\$ 25$ million revenue bond issue, to purchase an airport from a private company. The fair value of the assets and liabilities was as follows:

The city purchased the airport for the fair market value of its net assets.

2. Airlines were billed $\$ 3,700,000$ for rental rights to use ticket counters and landing and maintenance space. Of this amount, $\$ 3,690,000$ is expected to be collectible.

3. Supplies totaling $\$ 1,500$ were purchased on credit.

4. Collections from airlines totaled $\$ 3,680,000$.

5. Salaries of $\$ 200,000$ were paid to airport personnel employed by the city.

6. Utility bills totaling $\$ 100,000$ were paid.

7. A notice was received from the Last District Bankruptcy Court. Air Lussa was declared bankrupt. The airport collected only $\$ 1,000$ on its bill of $\$ 5,000$.

8. The airport obtained $\$ 3$ million of additional permanent contributions from the city to help finance improvements at the airport.

9. Interest of $\$ 2,125,000$ was paid to the bondholders.

10. Supplies used during the year totaled $\$ 1,200$.

11. The General Fund made an advance to the airport of $\$ 2$ million. This amount must be repaid within 5 years. Airport management plans to begin repaying the advance in 2005 .

12. A contract was signed with The Construction Company for the new facilities for a total price of $\$ 5$ million.

13. Airport management invested $\$ 2$ million in certificates of deposit.

14. Airport management received $\$ 315,000$ upon redeeming $\$ 300,000$ of the certificates of deposit mentioned in part (13).

15. The airport purchased additional equipment for $\$ 300,000$ cash.

16. Interest expense of $\$ 500,000$ was accrued at the end of the year.

17. Other accrued expenses totaled $\$ 50,000$.

18. Depreciation was recorded as follows:

19. Paid $\$ 13,000$ of Accounts payable.

20. Received $\$ 150,000$ of interest revenue.

21. Excess cash of $\$ 4.3$ million was invested in certificates of deposit.

Required: 1. Prepare the journal entries necessary to record the preceding transactions in the Municipal Airport Fund.

2. Prepare a trial balance at June 30, 2004.

3. Prepare a statement of revenues, expenses, and changes in net assets for the 2003-2004 fiscal year and a statement of net assets as of June 30, 2004.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch