(Multiple choice) 1. In government-wide financial statements, when is depreciation reported? a. Only for governmental activities b....

Question:

(Multiple choice)

1. In government-wide financial statements, when is depreciation reported?

a. Only for governmental activities

b. Only for business-type activities

c. For both governmental and business-type activities

d. For neither governmental nor business-type activities 2. In government-wide financial statements, for which activities is the economic resources measurement focus and accrual basis of accounting used?

a. Only for governmental activities

b. Only for business-type activities

c. For both governmental and business-type activities

d. For neither governmental nor business-type activities 3. Where are fiduciary-type funds reported?

a. Only in the fund financial statements

b. Only in the government-wide financial statements

c. In both fund and government-wide financial statements

d. In neither fund nor government-wide financial statements 4. The General Fund makes a transfer to the Debt Service Fund. How should the transfer be reported in the financial statements?

a. The transfers in and out should be reported in both the fund operating statement and the government-wide operating statement.

b. The transfers in and out should be reported in neither the fund operating statement nor the government-wide operating statement.

c. The transfers in and out should be reported in the fund operating statement, but not in the government-wide operating statement.

d. The transfers in and out should be reported in the government-wide operating statement, but not in the fund operating statement.

5. In government-wide financial statements, how are the net assets of Internal Service Funds generally treated?

a. They are ignored.

b. They are aggregated with business-type activities.

c. They are aggregated with fiduciary-type activities.

d. They are aggregated with governmental activities.

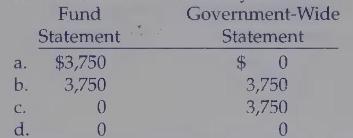

6. A city issues $\$ 100,000$ of 10 -year general obligation bonds on April 1, 2004 . It is required to pay debt service of $\$ 10,000$ on April 1 of each year, starting April 1, 2005, with interest of 5 percent on the unpaid principal. How much interest expenditure or expense should the city recognize in its operating statements for the calendar year 2004?

7. A village issues $\$ 3,000,000$ of general obligation bonds to build a new firehouse. How are the debt proceeds reported?

a. As a liability in the government-wide statement of net assets

b. As a liability in the fund financial statement

c. As proceeds of debt in the government-wide statement of activities

d. As a liability in the net assets section of the government-wide statement of net assets 8. A village levies property taxes in the amount of $\$ 940,000$ for the fiscal year ended June 30, 2005. It collects $\$ 900,000$ during the year. Regarding the $\$ 40,000$ of delinquent receivables, it expects to collect $\$ 25,000$ in July and August of 2005 and another $\$ 10,000$ after August but before March of 2006. It expects to write off $\$ 5,000$ as uncollectible. How much should the village recognize as property tax revenue in its government-wide statement of activities for the fiscal year ended June 30,2005 ?

a. $\$ 940,000$

b. $\$ 935,000$

c. $\$ 925,000$

d. $\$ 900,000$

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch