(Multiple choice) 1. The resources used to finance Capital Projects Funds may come from which of the...

Question:

(Multiple choice)

1. The resources used to finance Capital Projects Funds may come from which of the following sources?

a. Private donations

b. General obligation debt

c. Intergovernmental revenues

d. All of the above 2. The issuance of bonds to provide resources to construct a new courthouse should be recorded in a Capital Projects Fund by crediting which of the following accounts?

a. Bonds payable

b. Revenues-bonds

c. Fund balance

d. Proceeds from bond issue 3. What special entry must be made at the beginning of the new period when encumbrance accounting is used for a construction project that continues beyond the end of an accounting period?

a. A credit to Revenues

b. A debit to Cash

c. A debit to Expenditures

d. A debit to Encumbrances 4. What is done with resources that remain in a Capital Projects Fund after the project is completed?

a. Always transferred to a Debt Service Fund

b. Always returned to the provider(s) of the funds

c. Disbursed according to any restrictions in the agreement between the provider of the resources and the government

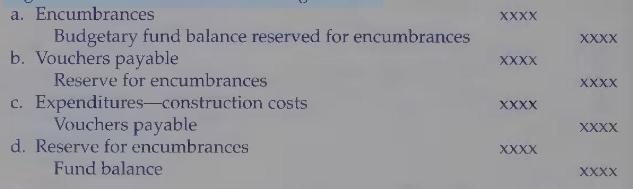

d. Always transferred to the General Fund 5. What journal entry is made in the Capital Projects Fund when a contract is signed and encumbrance accounting is used?

.6. The principal amount of bonds issued to finance the cost of a new city hall would be recorded as a liability in which of the following funds?

.6. The principal amount of bonds issued to finance the cost of a new city hall would be recorded as a liability in which of the following funds?

a. General Fund

b. Special Revenue Fund

c. Capital Projects Fund

d. Debt Service Fund

e. None of the above 7. Why is encumbrance accounting usually used in Capital Projects Funds?

a. Long-term debt is not recorded in these funds.

b. The budget must be recorded in these funds.

c. It helps the government to control the expenditures.

d. The modified accrual basis of accounting is used.

8. The City of New Easton constructed a new convention center. After com-

pletion of the project, the convention center should be recorded as an asset in which of the following funds?

a. General Fund

b. Capital Projects Fund

c. Debt Service Fund

d. Both b and c

e. None of the above

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch