The Society to Save Humankind from Its Ills, a VHWO, was founded in 2004. This organization conducts

Question:

The Society to Save Humankind from Its Ills, a VHWO, was founded in 2004. This organization conducts two types of programs: education and testing. It maintains three funds: Unrestricted Current; Restricted Current; and Land, Buildings and Equipment. During 2004, the following events took place:

1. Pledges amounting to $\$ 200,000$ were received. Of this amount, $\$ 50,000$ was restricted for the use of a special research program. All of the restricted pledges and $\$ 140,000$ of the unrestricted pledges are expected to be collected.

2. Les Miller made a $\$ 1,000$ cash contribution to be used as the directors of the society see fit. However, Mr. Miller stipulated that it not be used until 2005 .

3. The restricted pledges were all collected. With respect to the unrestricted pledges, $\$ 120,000$ was collected and $\$ 5,000$ was written off.

4. The society received a $\$ 10,000$ allocation from the United Fund. Of this amount, $\$ 2,000$ was deducted for fund-raising costs.

5. The society invested $\$ 10,000$ of unrestricted funds in government securities. Earnings on these resources amounted to $\$ 500$ in 2004.

6. During the year, $\$ 40,000$ of restricted funds was spent on the special research program.

7. A grant of $\$ 500,000$ was made to the society by the Allen Company. The grant was to be used to purchase equipment and for a down payment on a building. Cash donations of $\$ 10,000$, for the purpose of debt service (paying interest and principal on the mortgage), were also received.

8. Equipment was purchased for $\$ 75,000$, using resources donated by the Allen Company.

9. A down payment of $\$ 400,000$ was made on a building costing $\$ 1,000,000$. A 20-year mortgage was taken out for the remainder.

10. The following services were donated to the society, all of which should be recorded:

a. Free accounting work by a local accounting firm- $\$ 500$

b. Free tests by a national testing laboratory - $\$ 1,000$

c. The services, at no cost, of several teachers, from a local junior college, who conducted physical fitness and wellness programs- $\$ 2,000$

In addition, the accounting firm donated supplies worth $\$ 200$.

11. Salaries, wages, and other operating expenses for 2004 amounted to $\$ 135,000$. They were paid with unrestricted monies and were allocated as follows:

12. Interest of $\$ 8,000$ was paid on the mortgage during the year.

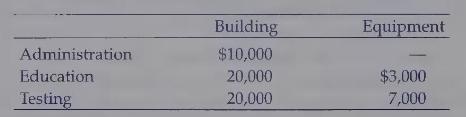

13. Depreciation amounted to $\$ 50,000$ on the building and $\$ 10,000$ on the equipment. It was allocated as follows:

14. Revenues from membership dues amounted to $\$ 18,000$ in 2004.

Required: Prepare journal entries for the preceding transactions by fund, identifying increases and decreases by net asset classification as appropriate.

Step by Step Answer:

Introduction To Government And Not For Profit Accounting

ISBN: 9780130464149

5th Edition

Authors: Martin Ives, Joseph R. Razek, Gordon A. Hosch