Canada-Wide Movers had the following account balances, in random order, on December 15, 2023 (all accounts have

Question:

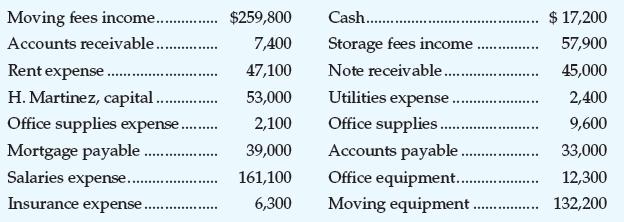

Canada-Wide Movers had the following account balances, in random order, on December 15, 2023 (all accounts have their “normal” balances):

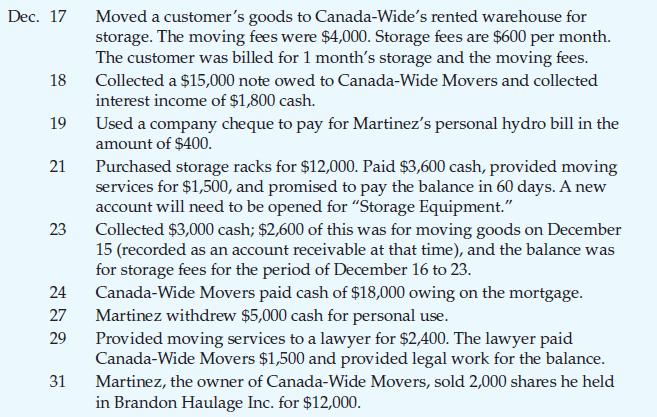

The following events took place during the final weeks of the year:

Required

1. Where appropriate, record each transaction from December 17 to 31 in the journal. Include an explanation for each journal entry.

2. Enter December 15 balances in the T-accounts.

3. Post entries in T-accounts and calculate the balance of each one.

4. Prepare the unadjusted trial balance of Canada-Wide Movers at December 31, 2023.

Cash.... 7,400 Storage fees income Note receivable........ Rent expense. 47,100 H. Martinez, capital................. 53,000 Office supplies expense........... 2,100 Mortgage payable.…...... 39,000 Salaries expense............ 161,100 Insurance expense..................... 6,300 Moving fees income.......... Accounts receivable................. ...... $259,800 ….…………………….. Utilities expense.. Office supplies............... Accounts payable...... Office equipment.............. Moving equipment. ************ $ 17,200 57,900 45,000 2,400 9,600 33,000 12,300 132,200

Step by Step Answer:

Journal Entries Date Account Title and Explanation Debit Credit Dec 17 Accounts Receivable 4000 Dec 17 Moving Fees Income 4000 Dec 17 Cash 4600 Dec 17 ...View the full answer

Horngrens Accounting Volume 1

ISBN: 9780136889373

12th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

CrossCountry Movers had the following account balances, in random order, on December 15, 2017 (all accounts have their "normal" balances): The following events took place during the final weeks of...

-

Cross Country Movers had the following account balances, in random order, on December 15, 2014 (all accounts have their "normal" balances): The following events took place during the final days of...

-

Maquina Lodge, owned by Bob Palmiter, had the following account balances, in random order, on December 15, 2023 (all accounts have their normal balances): The following events also took place during...

-

A stock is trading at $70. You believe there is a 70% chance the price of the stock will increase by 10% over the next 3 months. You believe there is a 10% chance the stock will drop by 10%, and you...

-

The Northwoods Outdoor Company is a catalog sales operation that specializes in outdoor recreational clothing. Demand for its items is very seasonal, peaking during the Christmas season and during...

-

What significant difficulty facing the supplier of goods and services in the construction industry is overcome by the creation of the builders lien? How can suppliers protect themselves? Explain the...

-

P2-5 Prepare an allocation schedule; compute income and the investment balance Pop Corporation paid $1,680,000 for a 30 percent interest in Son Corporations outstanding voting stock on January 1,...

-

Alexandra and Kellie operate a beauty salon as partners who share profits and losses equally. The success of their business has exceeded their expectations; the salon is operating quite profitably....

-

A piece of depreciable machinery is sold. It has been held for three years and qualifies as Section 1231 property. The selling price is greater than the adjusted basis but less than the original...

-

Write down the transactions relating to the ledger postings above Journalize the entries Using an email format, advise the owner of the business drawing on evidence from the balances in the T...

-

a. Indicate on which side of these accountsdebit (Dr) or credit (Cr)you would record an increase. _________ Accounts Receivable _________ Salaries Expense _________ John Ladner, Capital _________...

-

Haider Malik started a catering service called International Catering. During the first month of operations, October 2023, the business completed the following selected transactions: Required 1....

-

The Apex Company sold a water softener to Marty Smith. The price of the unit was $350. Marty asked for a deferred payment plan, and a contract was written. Under the contract, the buyer could delay...

-

You have recently taken over daycare center that was under substandard leadership. Currently, the staff is unmotivated, negative, and often absent from work. You notice that there is minimal...

-

Choose an organization from the industry of your choice to discuss, illustrate, and reflect deliberately on the following: Why is it important to distinguish between "group" and "team "? What kinds...

-

The focus of data governance programs, in some capacity, is enterprise-wide data quality standards and processes. If you were a manager focusing on master data: Would you likely meet enterprise-level...

-

1) Identify and explain each component of the ANOVA model. 2) How is the F ratio obtained? 3) What role does the F ratio play?

-

Make a BCG matrix table and place the following products from Apple: iPhone, iPad, iMac, iPod, Apple TV, Apple Watch, AirPod, and HomePod. Briefly describe why you have placed the products in the...

-

Refer to the quarterly Standard & Poor's 500 stock market index, Exercise 14.22. a. Use exponential smoothing with w = .7 to smooth the series from 2008 through 2014. Then forecast the quarterly...

-

What is the amount of total interest dollars earned on a $5,000 deposit earning 6% for 20 years?

-

On February 28, 2023, Rural Tech Support purchased a copy machine for $53,400. Rural Tech Support expects the machine to last for six years and have a residual value of $3,000. Compute depreciation...

-

On June 15, 2023, Family Furniture discarded equipment that had a cost of $27,000, a residual value of $0, and was fully depreciated. Journalize the disposal of the equipment.

-

On October 31, 2024, Alternative Landscapes discarded equipment that had a cost of $26,920. Accumulated Depreciation as of December 31, 2023, was $25,000. Assume annual depreciation on the equipment...

-

Your company BMG Inc. has to liquidate some equipment that is being replaced. The originally cost of the equipment is $120,000. The firm has deprecated 65% of the original cost. The salvage value of...

-

1. What are the steps that the company has to do in time of merger transaction? And What are the obstacle that may lead to merger failure? 2.What are the Exceptions to not to consolidate the...

-

Problem 12-22 Net Present Value Analysis [LO12-2] The Sweetwater Candy Company would like to buy a new machine that would automatically "dip" chocolates. The dipping operation currently is done...

Study smarter with the SolutionInn App