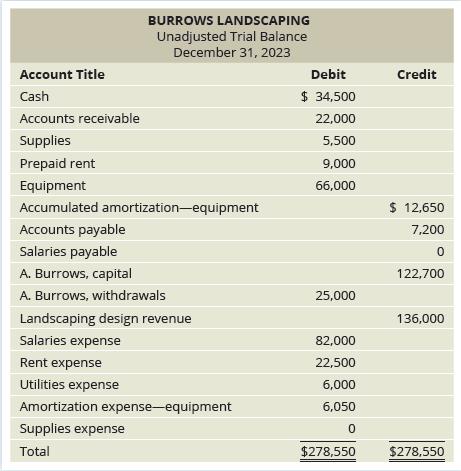

Consider the unadjusted trial balance of Burrows Landscaping at December 31, 2023, and the related month-end adjustment

Question:

Consider the unadjusted trial balance of Burrows Landscaping at December 31, 2023, and the related month-end adjustment data:

The following adjustments need to be made on December 31 before the financial statements for the year can be prepared:

a. Accrued landscaping design revenue, $8,500.

b. One month of the prepaid rent had been used. The unadjusted prepaid balance of $9,000 is for a period of 4 months.

c. Supplies remaining on hand, $900.

d. Amortization on equipment for the month of December. The equipment’s expected useful life is 10 years; it will have no value at the end of its useful life, and the straight-line method of amortization is used.

e. An accrual for 2 days of salaries is needed. A 5-day weekly payroll is $10,000.

Required

1. Sketch T-accounts in your notes to calculate the new balances. Prepare the adjusted trial balance of Burrows Landscaping at December 31, 2023.

2. Prepare the income statement (record expenses from largest to smallest on the income statement) and the statement of owner’s equity for the year ended December 31, 2023, and the balance sheet at December 31, 2023. Draw the arrows linking the three financial statements or write a short description of how they are linked.

Step by Step Answer:

Horngrens Accounting Volume 1

ISBN: 9780136889373

12th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura