FT Corporation reported the following amounts on its balance sheet at the start of the year: Short-term

Question:

FT Corporation reported the following amounts on its balance sheet at the start of the year:

Short-term investments .................................................. $ 104,000

Investments—Associated Companies at Equity ........ 15,000,000

Assume that FT Corporation completed the following investment transactions during

2020:

Mar. 2 Purchased 2,000 common shares as a short-term investment, paying $38.00 per share plus brokerage commission of $900.

5 Purchased additional shares in an associated company at a cost of $1,600,000. Brokerage commissions on the purchase were $30,000.

Jul. 21 Received the semi-annual cash dividend of $1.50 per share on the short-term investment purchased March 2.

Aug. 17 Received a cash dividend of $160,000 from an associated company.

Oct. 16 Sold 1,100 shares of the short-term investment (purchased on March 2) for $36.00 per share, less brokerage commission of $600. Nov. 8 Purchased short-term investments for $310,000, plus brokerage commission of $5,000.

17 Received a cash dividend of $280,000 from an associated company.

Dec. 31 Received annual reports from associated companies. Their total net income for the year was $6,900,000. Of this amount, FT’s proportion is 24 percent.

Required

1. Record the transactions in the general journal of FT Corporation.

2. Post entries to the Equity Investments T-account and determine its balance at December 31, 2020.

3. Post entries to the Short-Term Investments T-account and determine its balance at December 31, 2020.

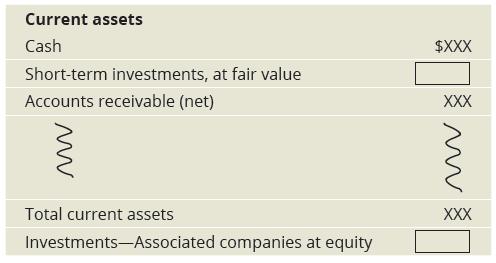

4. Assuming the market value of the short-term investment portfolio is $425,000 at December 31, 2020, show how FT Corporation would report short-term investments and investments in associated companies on the ending balance sheet. (No journal entry is required.) Use the following format:

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood