Loiselle and Randall formed a partnership on March 15, 2024. The partners agreed to contribute equal amounts

Question:

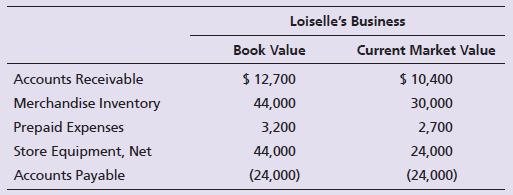

Loiselle and Randall formed a partnership on March 15, 2024. The partners agreed to contribute equal amounts of capital. Loiselle contributed her sole proprietorship’s assets and liabilities (credit balances in parentheses) as follows:

On March 15, Randall contributed cash in an amount equal to the current market value of Loiselle’s partnership capital. The partners decided that Loiselle will earn 60% of partnership profits because she will manage the business. Randall agreed to accept 40% of the profits. During the period ended December 31, the partnership earned net income of $79,000. Loiselle’s withdrawals were $41,000, and Randall’s withdrawals totaled $29,000.

Requirements

1. Journalize the partners’ initial contributions.

2. Prepare the partnership balance sheet immediately after its formation on March 15, 2024.

3. Journalize the closing of the Income Summary and partner Withdrawal accounts on December 31, 2024.

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison