Prepare journal entries for the following transactions. Explanations are not required. 2019 Jan. 1 May Dec. 31

Question:

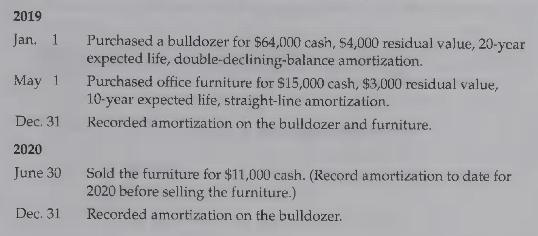

Prepare journal entries for the following transactions. Explanations are not required.

Transcribed Image Text:

2019 Jan. 1 May Dec. 31 2020 June 30 Dec. 31 Purchased a bulldozer for $64,000 cash, $4,000 residual value, 20-ycar expected life, double-declining-balance amortization. Purchased office furniture for $15,000 cash, $3,000 residual value, 10-year expected life, straight-line amortization. Recorded amortization on the bulldozer and furniture. Sold the furniture for $11,000 cash. (Record amortization to date for 2020 before selling the furniture.) Recorded amortization on the bulldozer.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Ankur Gupta

I have a degree in finance from a well-renowned university and I have been working in the financial industry for over 10 years now. I have a lot of experience in financial management, and I have been teaching financial management courses at the university level for the past 5 years. I am extremely passionate about helping students learn and understand financial management, and I firmly believe that I have the necessary skills and knowledge to effectively tutor students in this subject.

4.80+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A. Prepare journal entries for the following 2021 transactions or explain why no entry is required. Clearly label each account affected, and show any calculations necessary, but explanations for each...

-

Chapters 3 through 6 describe accounting and financial reporting by state and local governments. A continuous problem is presented to provide an overview of the reporting process, including...

-

The Balance Sheet of the General Fund of the City of Monroe as of December 31, 2019, follow. CITY OF MONROE General Fund Balance Sheet As of December 31, 2019 Assets Cash $ 503,000 Taxes...

-

Provide the appropriate statute for your answer (format style - IRAC - Issue, Rule, Application and Conclusion.) what are your thought? Problem Scenario- Earnest is married to Janice. Earnest and...

-

On a cold winter day, the outside temperature is 15.0C. Inside the house the temperature is + 20.0C. Heat flows out of the house through a window at a rate of 220.0 W. At what rate is the entropy of...

-

Though income is usually accounted for on an accruals concept, dividends proposed by an entity in which shares are held are not accounted for until received. The accounting convention used is: (a)...

-

LO6 Larry purchases machinery for his business (7-year MACRS property) on April 1 at a cost of $181,000. On June 1, he spends $84,000 for equipment (5-year MACRS property). a. What is the maximum...

-

Rights Red Shoe Co, had concluded that additional equity financing will be needed to expand operations and that the needed funds will be best obtained through a rights offering. It has correctly...

-

Kristen Lu purchased a used automobile for $25,100 at the beginning of last year and incurred the following operating costs: Depreciation ($25,100 = 5 years) Insurance Garage rent Automobile tax and...

-

In 2020, Camden Electronics purchased Winston Electronics, paying \(\$ 2.4\) million in a note payable. The market value of Winston Electronics' assets was \(\$ 3.1\) million, and Winston Electronics...

-

On January 13, 2019, Bill's Birdfeeders purchased store fixtures for \(\$ 65,000\) cash, expecting the fixtures to remain in service for 10 years. Bill's Birdfeeders has amortized the fixtures on a...

-

What are the tools and techniques to acquire innovative and inspiring ideas?

-

Stanley Medical Hospital is a non-profit and a non-chartered hospital planning to acquire several hospitals in the area. The hospital is researching financial options since they want to expand into...

-

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2022, for $12,000. They expect to use the...

-

Pacifico Company, a US-based importer of beer and wine, purchased 1,800 cases of Oktoberfest-style beer from a German supplier for 522,000 euros. Relevant U.S. dollar exchange rates for the euro are...

-

Complete the "Leadership Vision Questionnaire" in Chapter 7 (p176). Reflect on your results and complete the following prompts: Share the results from your questionnaire. Be sure to include the final...

-

1. Prepare el Presupuesto Operacional hasta completar el COGS (70 puntos) La empresa ACCO 295 tiene una venta proyectada de $450,000 Cada unidad se vende $450 Su inventario inicial 300 (costo $125)...

-

What does vertical analysis try to reveal?

-

The liquidliquid extractor in Figure 8.1 operates at 100F and a nominal pressure of 15 psia. For the feed and solvent flows shown, determine the number of equilibrium stages to extract 99.5% of the...

-

(the accounts on the bottom left can be changed) Effects of Sales Discounts Citron Mechanical Systems makes all sales on credit, with terms 1/15, n/30. During the year, the list price (prediscount)...

-

what do IRS guilines suggest as 3 critaria which generally, must be satified to characterize a worker as for the toolbar? does company commissioning a copyrighttable by an independent contractor own...

-

On January 1 , 2 0 X 5 , Pirate Company acquired all of the outstanding stock of Ship Incorporated, a Norwegian company, at a cost of $ 1 5 1 , 2 0 0 . Ship's net assets on the date of acquisition...

Study smarter with the SolutionInn App