Pria Developments Corp. is a Canadian real estate investment and development company looking to expand internationally. If

Question:

Pria Developments Corp. is a Canadian real estate investment and development company looking to expand internationally. If growth in this market continues, they will need to make a one-time change to report using IFRS, but they want to evaluate what this might look like and what implications this might have for readers of the financial statements. For the year ended December 31, 2019, Pria Developments prepared two sets of financial statements—one in accordance with ASPE and the other in accordance with IFRS.

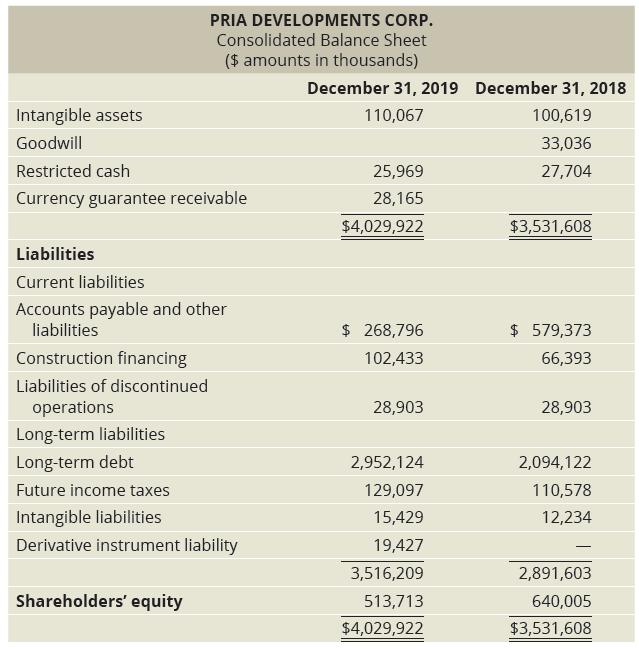

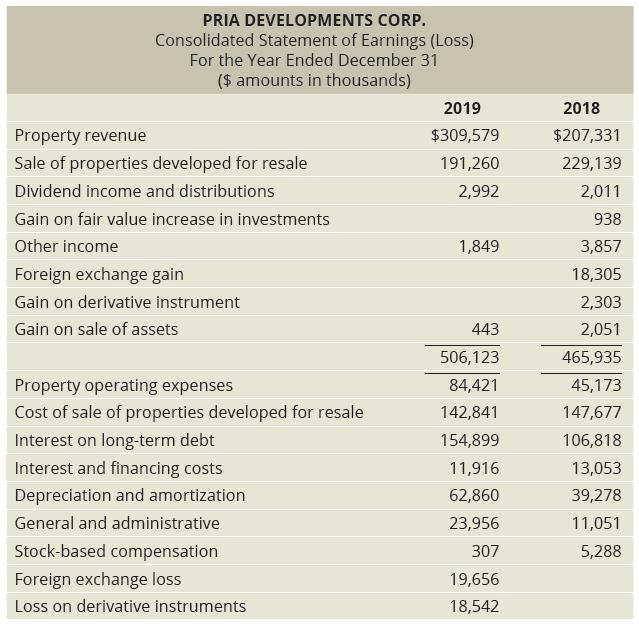

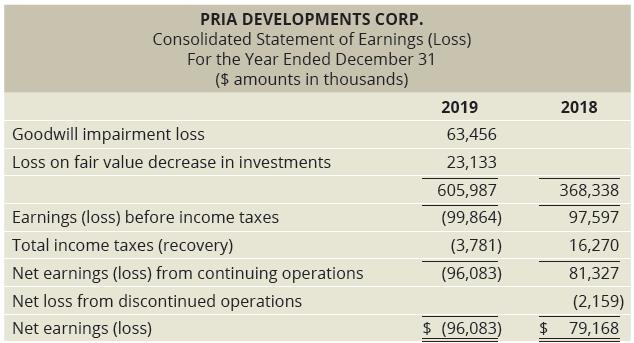

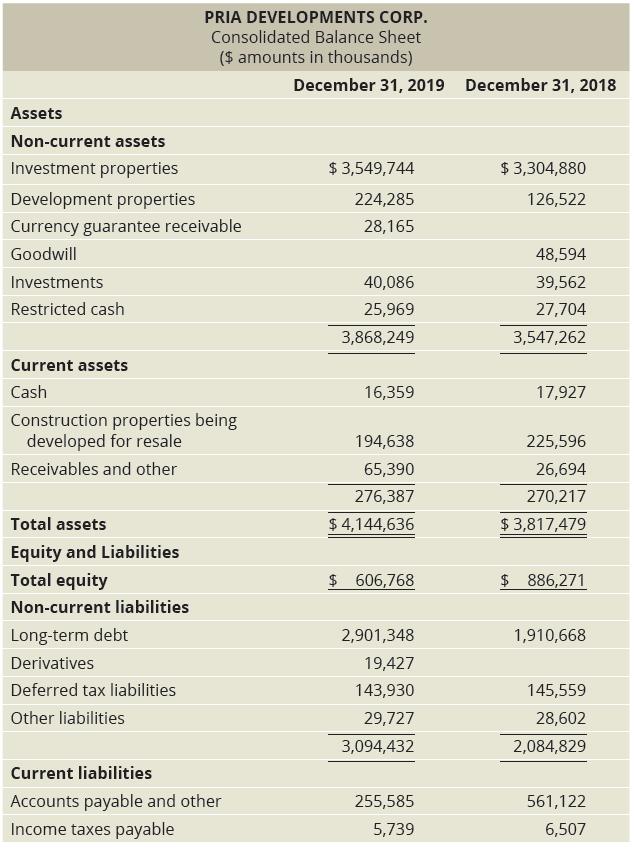

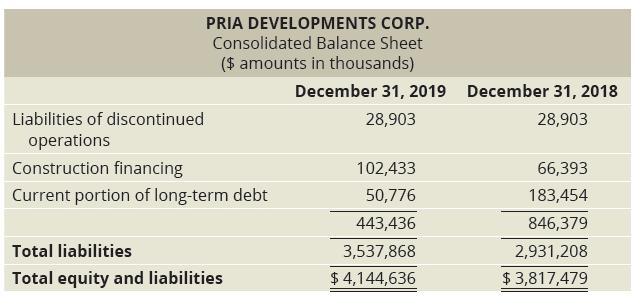

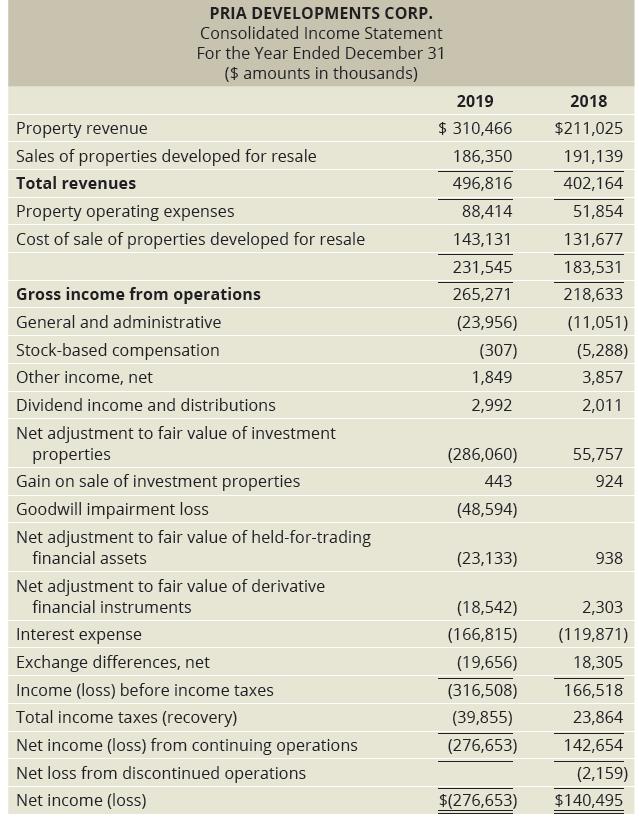

Excerpts from Pria Development’s financial statements appear below and on the following pages.

ASPE-Based Financial Statements:

IFRS-Based Financial Statements:

Notice that the presentation of the financial statements differs somewhat, as well as some of the recorded balances. These differences arise because ASPE and IFRS rules measure certain transactions differently. However, the focus of this question is the impact on ratios of using a different set of accounting rules. Investors need to understand that if two companies in the same industry are being compared, their results could be very different depending on whether IFRS or ASPE is used in the preparation of the financial information.

Required

1. Compute the following ratios for 2019 based on Pria Developments Corp.’s financial statements prepared in accordance with ASPE. Include both “interest on long-term debt” and “interest and financing costs” in your computations for part (d).

a. Current ratio

b. Acid-test ratio

c. Debt ratio

d. Return on assets

2. Compute the same ratios in Requirement 1 for 2019 based on Pria Developments Corp.’s IFRS financial statements.

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood