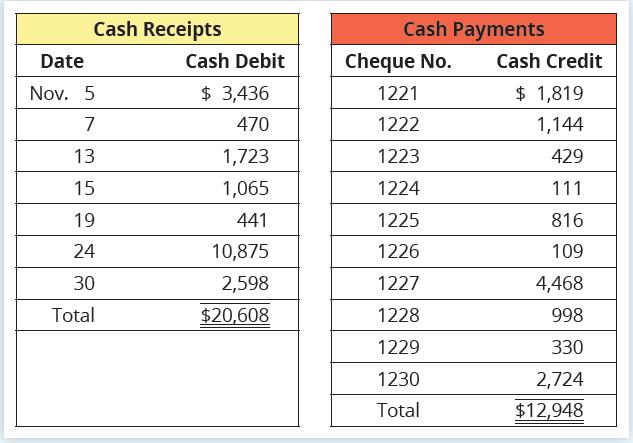

The cash receipts and the cash payments of Spinners Bowling for November 2023 are as follows: The

Question:

The cash receipts and the cash payments of Spinners Bowling for November 2023 are as follows:

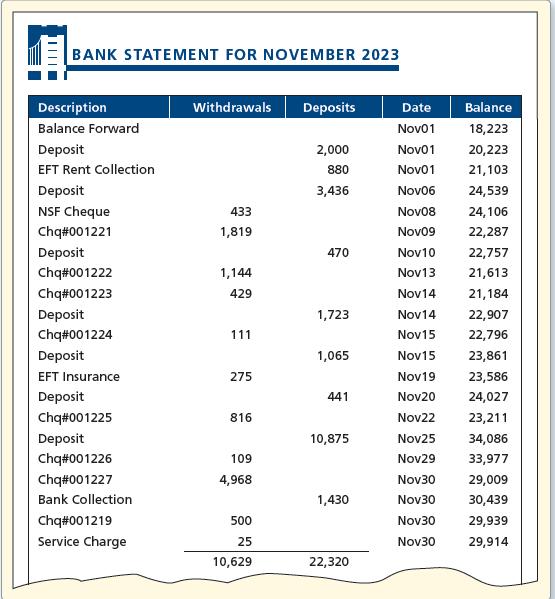

The Cash account of Spinners Bowling shows a balance of $26,983 on November 30, 2023. Outstanding amounts from the previous month’s bank reconciliation were cheque number 1219 for $500, cheque number 1218 for $400, and an October 31 deposit in the amount of $2,000. On December 3, 2023, Spinners Bowling received this bank statement:

Explanations: EFT—electronic funds transfer, NSF—nonsufficient funds Additional data for the bank reconciliation is as follows:

a. The EFT deposit was a receipt of rent for a special event. The EFT debit was payment for monthly insurance.

b. The NSF cheque was received late in October from a customer.

c. The $1,430 bank collection of a note receivable on November 30 included $100 interest revenue.

d. The correct amount of cheque number 1227, a payment on account, is $4,968. (Spinners Bowling’s accountant mistakenly recorded the cheque for $4,468.)

Required

1. Prepare the bank reconciliation of Spinners Bowling at November 30, 2023.

2. Describe how a bank account and the bank reconciliation help Spinners Bowling’s managers control the business’s cash.

3. How are outstanding items from the previous month’s bank reconciliation that clear on the November bank statement dealt with?

Step by Step Answer:

Horngrens Accounting Volume 1

ISBN: 9780136889373

12th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura