The following transactions of Belkin Howe occurred during 2024: Requirements 1. Journalize required transactions, if any, in

Question:

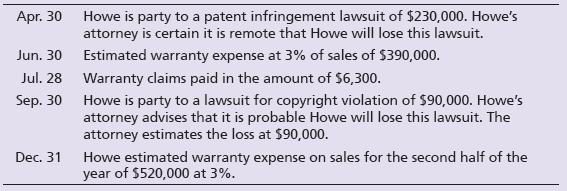

The following transactions of Belkin Howe occurred during 2024:

Requirements

1. Journalize required transactions, if any, in Howe’s general journal. Explanations are not required.

2. What is the balance in Estimated Warranty Payable assuming a beginning balance of $0?

Transcribed Image Text:

Apr. 30 Jun. 30 Jul. 28 Sep. 30 Dec. 31 Howe is party to a patent infringement lawsuit of $230,000. Howe's attorney is certain it is remote that Howe will lose this lawsuit. Estimated warranty expense at 3% of sales of $390,000. Warranty claims paid in the amount of $6,300. Howe is party to a lawsuit for copyright violation of $90,000. Howe's attorney advises that it is probable Howe will lose this lawsuit. The attorney estimates the loss at $90,000. Howe estimated warranty expense on sales for the second half of the year of $520,000 at 3%.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

1 2 Date 2024 Apr 30 Jun 30 Accounts and Explanation No entry requir...View the full answer

Answered By

ALBANUS MUTUKU

If you are looking for exceptional academic and non-academic work feel free to consider my expertise and you will not regret. I have enough experience working in the freelancing industry hence the unmistakable quality service delivery

4.70+

178+ Reviews

335+ Question Solved

Related Book For

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Students also viewed these Business questions

-

The Boston Trading Company, whose accounting year ends on December 31, had the following normal balances in its general ledger at December 31: Cash $15,000 Accounts Receivable 56,600 Inventory 74,000...

-

The following transactions of Belkin Howe occurred during 2018: Apr. 30 Howe is party to a patent infringement lawsuit of $230,000. Howe's attorney is certain it is remote that Howe will lose this...

-

Required Prepare General Journal entries to record the following transactions of Billington Company. 2015 Jan. 10, Accepted a $3,000, 60-day, 6% note dated this day in granting a time extension on...

-

Whitmore Company issued $500,000 of 5-year, 8% bonds at 97 on January 1, 2020. The bonds pay interest annually. Instructions a. 1. Prepare the journal entry to record the issuance of the bonds. 2....

-

This exercise can be done individually or, better yet, as a class project. For the pretzel packaging hypothesis test in Example 9.1 on page 342, the null and alternative hypotheses are, respectively,...

-

What is general knowledge? How does it differ from specific knowledge? Describe the types of specific knowledge with suitable examples.

-

9. Using the same information as the previous problem, suppose the interest rate on the borrowing date is 7.5%. Determine the dollar settlement of the FRA assuming a. Settlement occurs on the date...

-

I-Go Airlines has operations in eight cities throughout the United States. It is searching for the best location(s) to designate as a hub, which would then serve other cities within a 1,400-mile...

-

1. Why did the introduction of the Corporate Shield lead to a significant increase in business activity and funding? 2. For one point list six of the categories we covered in class that might lead to...

-

Compute the Gross Estate of Mr. Narsiso if he is a. Resident Citizen b. Non-Resident Alien - without Reciprocity c. Non-Resident Alien - with Reciprocity Bank deposit at China Bank, Ayala Ave.,...

-

The income statement for Vermont Communications, Inc. follows. Assume Vermont Communications, Inc. signed a three-month, 3%, $6,000 note on June 1, 2024, and that this was the only note payable for...

-

What do short-term notes payable represent?

-

Apply incremental costs in decision making

-

The combined weight of the load and the platform is 200 lb, with the center of gravity located at G. If a couple moment of M = 900 lb ft is applied to link AB, determine the angular velocity of links...

-

Due In: 06:48:23 Questions Question 1 (4) O Question 2 (8) Question 2 of 2 A company sold $150,000 bonds and set up a sinking fund that was earning 8.5% compounded semi-annually to retire the bonds...

-

Find the point on the graph of f(x) = x which is closest to the point (6, 27). How close is the closest point?

-

Due to a crash at a railroad crossing, an overpass is to be constructed on an existing level highway. the existing highway has a design speed of 50 mi/h. The overpass structure is to be level,...

-

Finding Bone Density Scores. In Exercises 37-40 assume that a randomly selected subject is given a bone density test. Bone density test scores are normally distributed with a mean of 0 and a standard...

-

In TCP, how many sequence numbers are consumed by each of the following segments? a. SYN b. ACK c. SYN + ACK d. Data

-

In Problems 1522, find the principal needed now to get each amount; that is, find the present value. To get $750 after 2 years at 2.5% compounded quarterly.

-

Surf and Sun had the following balances at December 31, 2018, before the year-end adjustments: The aging of accounts receivable yields the following data: Requirements 1. Journalize Surf and Sun's...

-

A table of notes receivable for 2018 follows: For each of the notes receivable, compute the amount of interest revenue earned during 2018. Round to the nearest dollar. Interest Period During 2018...

-

Sears Holdings Corporation is the parent company of Kmart Holding Corporation and Sears, Roebuck and Co. The corporation operates more than 1,600 retail stores in the United States and offers online...

-

Maddox Resources has credit sales of $ 1 8 0 , 0 0 0 yearly with credit terms of net 3 0 days, which is also the average collection period. Maddox does not offer a discount for early payment, so its...

-

Selk Steel Co., which began operations on January 4, 2017, had the following subsequent transactions and events in its long-term investments. 2017 Jan. 5 Selk purchased 50,000 shares (25% of total)...

-

Equipment with a book value of $84,000 and an original cost of $166,000 was sold at a loss of $36,000. Paid $100,000 cash for a new truck. Sold land costing $330,000 for $415,000 cash, yielding a...

Study smarter with the SolutionInn App