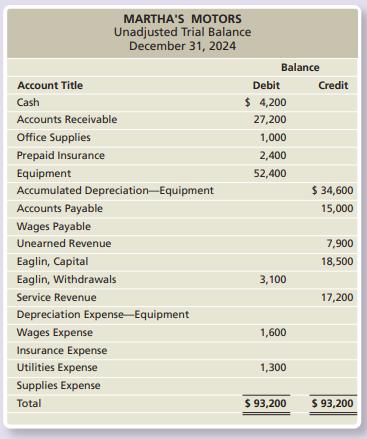

The unadjusted trial balance and adjustment data of Marthas Motors at December 31, 2024, follow: Adjustment data

Question:

The unadjusted trial balance and adjustment data of Martha’s Motors at December 31, 2024, follow:

Adjustment data at December 31, 2024:

a. Depreciation on equipment, $2,100.

b. Accrued Wages Expense, $1,100.

c. Office Supplies on hand, $500.

d. Prepaid Insurance expired during December, $600.

e. Unearned Revenue earned during December, $4,800.

f. Accrued Service Revenue, $1,300. 2025 transactions:

a. On January 4, Martha’s Motors paid wages of $1,900. Of this, $1,100 related to the accrued wages recorded on December 31.

b. On January 10, Martha’s Motors received $1,500 for Service Revenue. Of this, $1,300 is related to the accrued Service Revenue recorded on December 31.

Requirements

1. Journalize adjusting entries.

2. Journalize reversing entries for the appropriate adjusting entries.

3. Refer to the 2025 data. Journalize the cash payment and the cash receipt that occurred in 2025.

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison