This comprehensive problem is a continuation of Comprehensive Problem 1. Murphy Delivery Service has completed closing entries

Question:

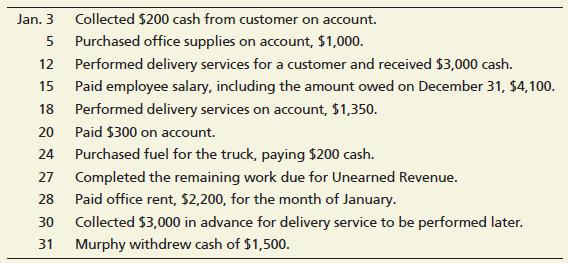

This comprehensive problem is a continuation of Comprehensive Problem 1. Murphy Delivery Service has completed closing entries and the accounting cycle for 2024. The business is now ready to record January 2025 transactions.

Requirements

1. Record each January transaction in the journal. Explanations are not required.

2. Post the transactions in the T-accounts. Don’t forget to use the December 31, 2024, ending balances as appropriate.

3. Prepare an unadjusted trial balance as of January 31, 2025.

4. Prepare a worksheet as of January 31, 2025 (optional).

5. Journalize the adjusting entries using the following adjustment data and also by reviewing the journal entries prepared in Requirement 1. Post adjusting entries to the T-accounts.

Adjustment data:

a. Office Supplies on hand, $600.

b. Accrued Service Revenue, $1,800.

c. Accrued Salaries Expense, $500.

d. Prepaid Insurance for the month has expired.

e. Depreciation was recorded on the truck for the month.

6. Prepare an adjusted trial balance as of January 31, 2025.

7. Prepare Murphy Delivery Service’s income statement and statement of owner’s equity for the month ended January 31, 2025, and the classified balance sheet on that date. On the income statement, list expenses in decreasing order by amount— that is, the largest expense first, the smallest expense last.

8. Calculate the following ratios as of January 31, 2025, for Murphy Delivery Service: return on assets, debt ratio, and current ratio.

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison