Completing the accounting cycle from journal entries to postclosing trial balance with a worksheet On December 1,

Question:

Completing the accounting cycle from journal entries to postclosing trial balance with a worksheet On December 1, Zaray Avelino began an auto repair shop, Avelino’s Quality Automotive.

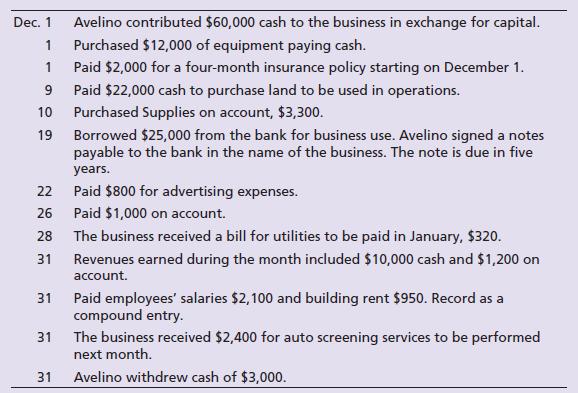

The following transactions occurred during December:

The business uses the following accounts: Cash; Accounts Receivable; Supplies;

Prepaid Insurance; Land; Equipment; Accumulated Depreciation—Equipment;

Accounts Payable; Utilities Payable; Interest Payable; Unearned Revenue; Notes Payable;

Avelino, Capital; Avelino, Withdrawals; Income Summary; Service Revenue;

Salaries Expense; Rent Expense; Utilities Expense; Advertising Expense;

Supplies Expense; Insurance Expense; Interest Expense; and Depreciation Expense—Equipment.

Adjustment data:

a. Supplies used during the month, \($1,000\).

b. Depreciation for the month, \($400\).

c. One month insurance has expired.

d. Accrued Interest Expense, \($100\).

Requirements

1. Prepare the journal entries and post to the T-accounts.

2. Complete the worksheet for the month ended December 31, 2025.

3. Prepare the adjusting entries and post to the T-accounts.

4. Prepare the income statement, the statement of owner’s equity, and the classified balance sheet in report form.

5. Prepare the closing entries and post to the T-accounts.

6. Prepare a post-closing trial balance.

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780137884858

14th Edition

Authors: Brenda Mattison, Tracie Miller-Nobles