Blanda Brothers is a produce processing company that specializes in fruits, with apple sales representing the majority

Question:

Blanda Brothers is a produce processing company that specializes in fruits, with apple sales representing the majority of their revenue. Their main facility receives a daily shipment of apples, which are then sorted and shipped to grocery stores and to producers of apple jelly and juice, depending on the apple quality (sweetness, taste, color, etc.). The acceptable-quality apples are sold to grocery stores and low-quality apples are sold to apple processors. If a low-quality apple is sold to a grocery store, the apples are returned and Blanda must pay the stores a fee to compensate the store for lost sales and for the extra work of shipping the apples back. Blanda’s reputation also suffers, affecting future business. Blanda has an algorithm to determine apple quality, but the algorithm is not perfect and misclassifies apples.

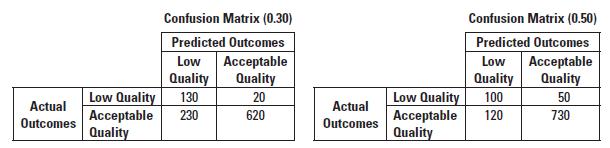

The data science team presents their work to Cindy Hansen, the management accountant at Blanda, to help them choose between two cutoff prediction probabilities for low-quality apples of 0.50 and 0.30. Apples with a predicted probability above the cut-off probability are classified as low quality, and apples below the cut-off probability are classified as acceptable quality apples. The following confusion matrices are based on the validation sample.

Required

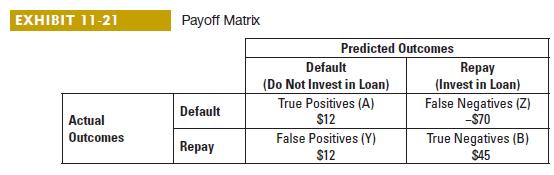

1. Cindy estimates that apples of acceptable quality result in a profit of $0.30 per apple. She also knows that low-quality apples can be sold to juice companies at a profit of $0.04. Finally, she estimates that the cost to Blanda of selling a low-quality apple to the grocery store as an acceptablequality apple is $1.05 for each low-quality apple. Use this information to construct a payoff matrix as in Exhibit 11-21.

2. Using Cindy’s knowledge about the payoff of each outcome, which threshold should the team choose?

2. Using Cindy’s knowledge about the payoff of each outcome, which threshold should the team choose?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan