Capital budgeting, make versus buy, income taxes, relevant costs. (CMA, adapted) The equipment owned and operated by

Question:

Capital budgeting, make versus buy, income taxes, relevant costs. (CMA, adapted) The equipment owned and operated by the Protect-it Company and used to manufacture waste containers must be replaced because it is irreparable. The old equipment has a current salvage price of $1,800. The new equipment would cost $1,373,700. The equip-

| Total present value ment would go into service on January 1, 2010, and would have a five-year useful life. Under alee tebe the prevailing income tax laws, capital cost allowance is calculated on the declining-balance method at a rate of 25%. The terminal disposal price at the end of five years is estimated at

$14,400.

Protect-it estimates the following number of waste containers will be needed over the next five years: 2010, 50,000; 2011, 50,000; 2012, 52,000; 2013, 55,000; 2014, 55,000 for its products.

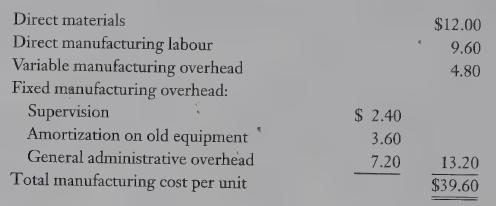

Protect-it’s current manufacturing costs for waste containers are as follows:

An outside supplier has offered to supply all the containers that Protect-it needs over the next five years at a fixed price of $35.75 per container. If the supplier's offer is accepted, Protect-it would not need to replace the equipment.

If the waste containers are purchased outside, the salary and benefits of one supervisor, included in the fixed overhead at $62,000, would be eliminated. There would, however, be no change in general administrative overhead. Protect-it has no alternative use for the extra space that would become available if the containers were purchased from outside.

Working capital requirements are approximately the same whether the containers are made or purchased.

Protect-it has a 40% marginal income tax rate. Its after-tax required rate of return on new equipment is 12%.

REQUIRED 1. Use a net present value analysis to determine whether Protect-it should purchase the waste containers from the outside supplier or purchase the new equipment.

2. What nonfinancial and qualitative factors should Protect-it consider before coming to a decision?

LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing