Cost allocation and decision making. Greenbold Manufacturing has four divisions named after its locations: Ontario, Alberta, Yukon,

Question:

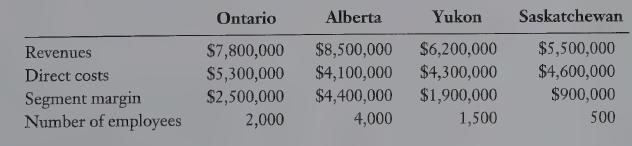

Cost allocation and decision making. Greenbold Manufacturing has four divisions named after its locations: Ontario, Alberta, Yukon, and Saskatchewan. Corporate headquarters is in Manitoba. Greenbold corporate headquarters incurs $5,600,000 per period, which is an indirect cost of the divisions. Corporate headquarters currently allocates this cost to the divisions based on the revenues of each division. The CEO has asked each division manager to suggest an allocation base for the indirect headquarters costs from among revenues, segment margin, direct costs, and number of employees. Below is relevant information about each division:

REQUIRED 1. Allocate the indirect headquarters costs of Greenbold Manufacturing to each of the four divisions using revenues, direct costs, segment margin, and number of employees as the allo- cation bases. Calculate operating margins for each division after allocating headquarters costs. 2. Which allocation base do you think the manager of the Saskatchewan division would prefer? Explain. 3. What factors would you consider in deciding which allocation base Greenbold should use? 4. Suppose the Greenbold CEO decides to use direct costs as the allocation base. Should the Saskatchewan division be closed? Why or why not?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing