CVP, income taxes, manufacturing decisions. (J. Watson) Prairie Ltd. currently manufactures a single product in its Saskatoon

Question:

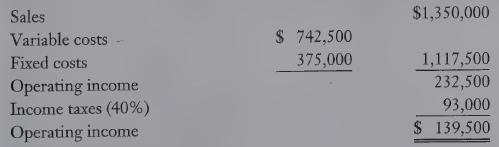

CVP, income taxes, manufacturing decisions. (J. Watson) Prairie Ltd. currently manufactures a single product in its Saskatoon factory. Last year’s results (based on sales volume of 25,000 units) were

REQUIRED 1. Using last year’s data, calculate Prairie’s breakeven point in units and calculate the margin of safety in dollars.

2. How many units of product would Prairie have had to sell last year if it wished to oon $225 000 in net income? Cost-Volume-Profit Analysis 3. In an attempt to improve its product quality, Prairie is considering replacing one of its current component parts. This part costs $7.50 (one component per finished unit), and Prairie is evaluating a new and better part that has a cost of $9.80 per unit. The company would simultaneously expand its production by investing in a machine that costs $25,000.

This machine has no salvage value and would be amortized on as traight-line basis over five years (assume this is acceptable for both financial-statement and tax purposes). If these changes are made and selling price is held constant:

a. Calculate the new breakeven point in units. °

b. Determine how many units of product must be sold next year to achieve the same net income after taxes as last year.

4. Instead of the changes in requirement 3, the company is considering adding a higherquality product to its sales mix. This new product would sell for $95 and variable costs per unit would increase by 60% over the old product. Total unit sales are forecast to increase to 50,000 units (which is in the company’s current capacity—no additional fixed costs are needed) and the sales mix is estimated to be 3:2 (old product to new product). If Prairie introduces this new product at the planned sales mix, calculate the new breakeven point in sales dollars.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing