Defensive and offensive strategies in capital budgeting. (CMA, adapted) The manage- ment of Kleinburg Industrial Bakery is

Question:

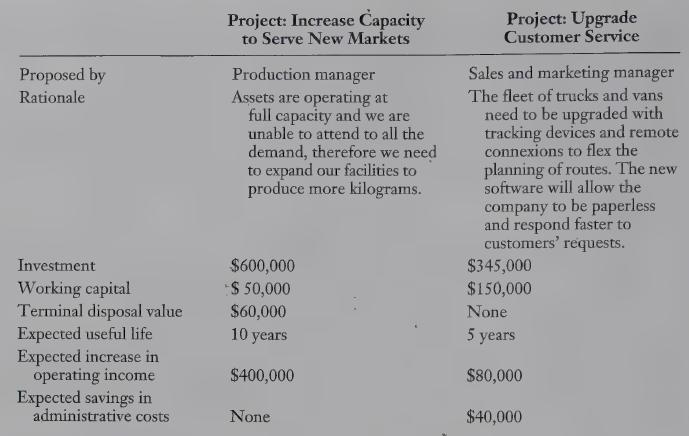

Defensive and offensive strategies in capital budgeting. (CMA, adapted) The manage- ment of Kleinburg Industrial Bakery is analyzing two competing investment projects and they must decide which one can be done immediately and which one can be postponed for at least a year. The details of each proposed investment are shown on the next page. The Bakery has a 12% required rate of return to evaluate all investments that directly impact operations and amortizes the investment in plant and equipment using straight-line amortization over 10 years on the difference between the initial investment and terminal dis- posal price. REQUIRED 1. Calculate the net present value of each proposal. 2. Which project should the Bakery choose on the basis of the NPV calculations? 3. Mention which strategic factors must be considered by the managers when ranking the projects.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing