Direct and indirect costs; computing and interpreting unit manufacturing costs. eens Maximum Office Products (MOP) produces three

Question:

Direct and indirect costs; computing and interpreting unit manufacturing costs.

eens Maximum Office Products (MOP) produces three different paper products at its Vernon Deluxe $1.3833 lumber plant—Supreme, Deluxe, and Regular. Each product has its own dedicated production Regular $0.94 line at the plant. MOP currently uses the following three-part classification for its manufacturing costs: direct materials, direct manufacturing labour, and indirect manufacturing costs.

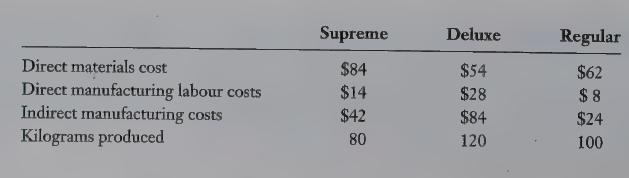

¥ ‘Total indirect manufacturing costs of the plant in May 2009 are $150 million ($20 million of which are fixed). This total amount is allocated to each product line on the basis of direct manufacturing labour costs of each line. Summary data (in millions) for May 2009 are:

REQUIRED 1. Compute the manufacturing cost per Kilogram for each product produced in May 2009.

2. Suppose that in June 2009, production was 120 million Kilograms of Supreme, 160 million Kilograms of Deluxe, and 180 million Kilograms of Regular. Why might the May 2009 information on manufacturing cost per Kilogram be misleading when predicting total manufacturing costs in June 2009?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing