Disposition of overhead overallocation or underallocation, two indirect cost pools. Glavine Corporation manufactures precision equipment made to

Question:

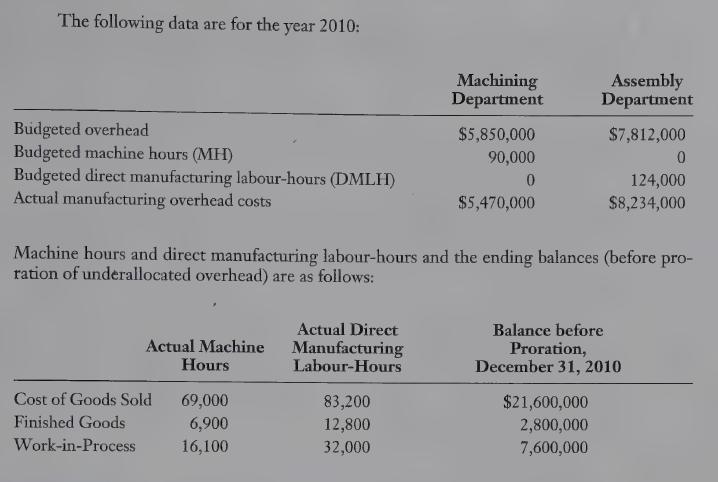

Disposition of overhead overallocation or underallocation, two indirect cost pools. Glavine Corporation manufactures precision equipment made to order for the semiconduc- tor industry. Glavine uses two manufacturing overhead cost pools-one for the overhead costs incurred in its highly automated Machining Department and another for overhead costs incurred in its labour-based Assembly Department. Glavine uses a normal costing system. It allocates Machining Department overhead costs to jobs based on actual machine hours using a budgeted machine hour overhead rate. It allocates Assembly Department overhead costs to jobs based on actual direct manufacturing labour-hours using a budgeted direct manufactur- ing labour-hour rate.

REQUIRED 1. Compute the budgeted overhead rates for the year in the Machining and Assembly Departments.

2. Compute the underallocated or overallocated overhead in each department for the year.

Dispose of the underallocated or overallocated amount in each department using:

a. Immediate write-off to Cost of Goods Sold.

b. Proration based on ending balances (before proration) in Cost of Goods Sold, Finished Goods, and Work-in-Process.

c. Proration based on the allocated overhead amount (before proration) in the ending balances of Cost of Goods Sold, Finished Goods, and Work-in-Process.

3. Which disposition method do you prefer in requirement 2? Explain.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing