Job costing with multiple direct-cost categories, single indirect-cost pool, law firm (continuation of 5-28). Hanley asks his

Question:

Job costing with multiple direct-cost categories, single indirect-cost pool, law firm

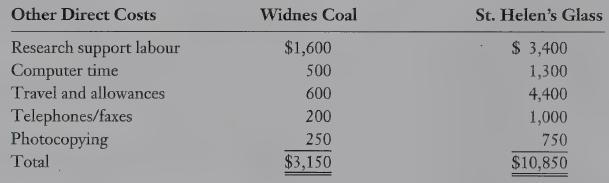

(continuation of 5-28). Hanley asks his assistant to collect details on those costs included in the $21,000 indirect-cost pool that can be traced to each individual case. After further analysis, Wigan is able to reclassify $14,000 of the $21,000 as direct costs:

Hanley decides to calculate the costs of each case had Wigan used six direct-cost pools and a single indirect-cost pool. The single indirect-cost pool would have $7,000 of costs and would be allocated to each case using the professional labour-hours base.

REQUIRED 1. What is the revised indirect cost-allocation rate per professional labour-hour for Wigan Associates when total indirect costs are $7,000?

2. Compute the costs of the Widnes and St. Helen’s cases if Wigan Associates had used its refined costing system with multiple direct-cost categories and one indirect-cost pool.

3. Compare the costs of the Widnes and St. Helen’s cases in requirement 2 with those in requirement 2 of Problem 5-28. Comment on the results.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing