Joint cost allocation, process further or sell byproducts. (CMA) The Remarkable Pharma- ceutical Company manufactures three

Question:

Joint cost allocation, process further or sell byproducts. (CMA) The Remarkable Pharma- ©

ceutical Company manufactures three joint products from a joint process: Alpha, Beta, and

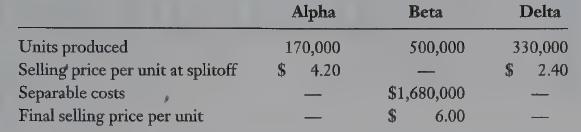

; 1. Estimated net realizabl Delta. Data regarding these products for the fiscal year ended May 31, 2010, are as follows:

The joint production cost up to the splitoff point where Alpha, Beta, and Delta become separable products is $2,160,000 (which includes the $21,000 disposal costs for Dorzine as described below).

The president of Remarkable, Martha Wellington, is reviewing an opportunity to change the way in which these three products are processed and sold. Proposed changes for each product are as follows:

@ Alpha is currently sold at the splitoff point to a manufacturer of vitamins. Alpha can also be refined for use as a medication to treat high blood pressure; however, this additional processing would cause a loss of 20,000 units of Alpha. The separable costs to further process Alpha are estimated to be $300,000 annually. The final product would sell for $6.60 per unit.

@ Beta is currently processed further after the splitoff point and sold by Remarkable as a cold remedy. The company has received an offer from another pharmaceutical company to purchase Beta at the splitoff point for $2.70 per unit.

@ Delta is an oil produced from the joint process and is currently sold at the splitoff point to a cosmetics manufacturer. Remarkable’s research department has suggested that the company process this product further and sell it as an ointment to relieve muscle pain. The additional processing would cost $90,000 annually and would result in 25% more units of product. The final product would be sold for $2.16 per unit.

The joint process currently used by Remarkable also produces 50,000 units of Dorzine, a hazardous chemical waste product. The company pays $0.42 per unit to dispose of the Dorzine properly. Dietriech Mills Inc. is interested in using the Dorzine as a solvent, however, Remarkable would have to refine the Dorzine at an annual cost of $51,600. Dietriech would purchase all the refined Dorzine produced by Remarkable and is willing to pay $0.90 for each unit.

INSTRUCTIONS Form groups of two or more students to complete the following requirements.

REQUIRED 1. Allocate the $2,160,000 joint production cost to Alpha, Beta, and Delta using the estimated NRV method.

2. Identify which of the three joint products Remarkable should sell at the splitoff point in the future and which of the three main products the company should process further to maximize profits. Support your decisions with appropriate calculations.

3, Assume that Remarkable has decided to refine the waste product Dorzine for sale to Dietriech Mills Inc. and will treat Dorzine as a byproduct of the joint process in the future.

a. Evaluate whether Remarkable made the correct decision regarding Dorzine. Support your answer with appropriate calculations.

b. Explain whether the decision to treat Dorzine as a byproduct will affect the decisions reached in requirement 2.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing