Joint costs and byproducts. (W. Crum) Royston Inc. is a large food processing company. It 1. Net

Question:

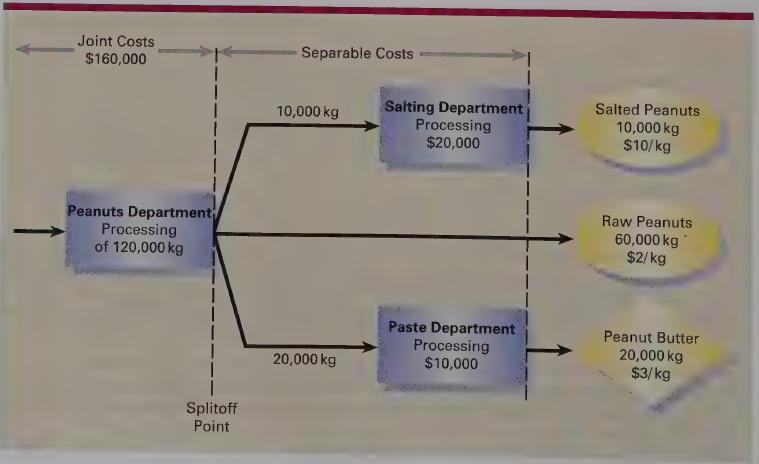

Joint costs and byproducts. (W. Crum) Royston Inc. is a large food processing company. It 1. Net joint costs to be processes 120,000 kilograms of peanuts in the Peanuts Department at a cost of $160,000 to allocated, $131,000 yield 10,000 kilograms of product A, 60,000 kilograms of product B, and 20,000 kilograms of product C.

® Product A is processed further in the Salting Department to yield 10,000 kilograms of salted peanuts at a cost of $20,000 and sold for $10 per kilogram.

® Product B (Raw Peanuts) is sold without further processing at $2 per kilogram.

® Product C is considered a byproduct and is processed further in the Paste Department to yield 20,000 kilograms of peanut butter at a cost of $10,000 and sold for $3 per kilogram.

The company wants to make a gross margin of 10% of revenues on product C and needs to allow 25% of revenues for marketing costs on product C. An overview of operations follows:

REQUIRED 1. Compute unit costs per kilogram for products A, B, and C, treating C as a byproduct. Use the NRV method for allocating joint costs. Deduct the NRV of the byproduct produced from the joint cost of products A and B.

2. Compute unit costs per kilogram for products A, B, and C, treating all three as joint products and allocating joint costs by the NRV method.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing