Life-cycle product costing. Intentical Inc. manufactures game systems. Intentical has decided to create and market a new

Question:

Life-cycle product costing. Intentical Inc. manufactures game systems. Intentical has decided to create and market a new system with wireless controls and excellent video graphics.

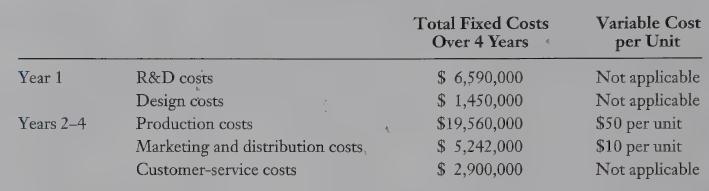

Intentical’s managers are thinking of calling this system the Yew. Based on experience, they expect the total life cycle of the Yew to be four years. They budget the following costs for the Yew:

REQUIRED 1. Suppose the managers price the Yew game at $110 pér unit. How many units do they need to sell to break even?

2. The managers are reviewing two alternative pricing strategies:

a. Sell the Yew at $110 each from the outset. At this price they expect to sell 1,500,000 units over its life cycle.

b. Boost the selling price of the Yew in year 2 when it first comes out to $240. At this price, they expect to sell 100,000 units in year 2. In years 3 and 4, they will drop the price to $110 per unit and believe unit sales will be 1,200,000.

What pricing strategy would you recommend? Explain.

3. What other factors should Intentical consider in choosing its pricing strategy?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing