Make versus buy, governance. (CMA, adapted) Lynn Hardt, a management accountant with the Paibec Corporation, is evaluating

Question:

Make versus buy, governance. (CMA, adapted) Lynn Hardt, a management accountant with the Paibec Corporation, is evaluating whether a component, MTR-85, should continue

% to be manufactured by Paibec or purchased from Marley Company, an outside supplier.

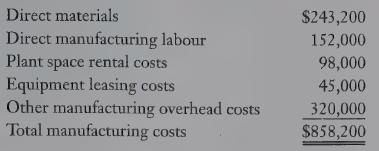

Marley has submitted a bid to manufacture and supply the 35,000 units of MTR-85 that Paibec will need'for 2011 at a unit price of $22.20 to be delivered according to Paibec’s production specifications and needs. While the contract price of $22.20 is applicable only in 2011, Marley is interested in entering into a long-term arrangement beyond 2011. Hardt has collected the following additional information related to manufacturing 32,000 units of MTR-85 in the previous year.

Direct materials used in the production of MTR-85 are expected to increase 6% in 2011. Paibec's direct manufacturing labour contract calls for an 8% increase in 2011. Paibec can withdraw from the plant space rental agreement without any penalty. Paibec will have no need for this space if MTR-85 is not manufactured. The equipment lease can be terminated by paying $8,500. Sixty percent of the other manufacturing overhead is considered variable. Variable over- head changes with the number of units produced. The rate per unit is not expected to change in 2011. The fixed manufacturing overhead costs are not expected to change whether or not MTR-85 is manufactured. John Porter, plant manager at Paibec Corporation, is concerned that Hardt's analysis may lead to the closing down of the MTR-85 line. Porter indicates to Hardt that the current performance of the plant can be significantly improved on and that the price increases she is assuming are unlikely to occur. Hence, the analysis should be done assum- ing costs will be considerably below current levels. Hardt knows that Porter is concerned about outsourcing MTR-85 because it will mean that some of his close friends will be laid off. Furthermore, Porter had played a key role in convincing management to produce MTR-85 in-house. Hardt believes that it is unlikely the plant will achieve the lower costs Porter describes. She is very confident about the accuracy of the information she has collected, but she is unhappy about laying off employees.

REQUIRED 1. Based on the information Hardt has obtained, should Paibec make MTR-85 or buy it? Show all calculations.

2. What other factors should Paibec consider before making a decision?

3. What should Lynn Hardt do in response to John Porter’s comments?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing